17-09-19

From George Lucas, Raiz CEO

Global recession worries aren’t gone

This week, chatter about a potential global recession continued, despite the International Monetary Fund (IMF) saying that it is “far” from forecasting such an event, according to news agency Reuters. Indeed, although growth is slowing, economies are still expected to grow, just at a slow rate.

Interestingly, the stock market has not really factored in a recession or growth slowdown into current prices. That’s clear if we look so far at September, which has not been volatile and has in fact seen the market move up, including the S&P500 again approaching all-time highs.

A possible volatile month for markets ahead

Still, although September can be volatile it is usually October where sharp market movement occur. Even so, there are signs to the contrary. For instance, the jobs market is strong globally and hence it is difficult to imagine a credit event that could cause a global financial crisis-style market event when employment is strong.

Similarly, robust employment means people are paying taxes, which can only help governments meet their obligations and boost infrastructure spending. Companies, meanwhile, are still hiring, with the latest NAB business conditions survey in Australia showing that companies’ intention to hire have improved, despite overall business conditions falling 2.0 points to +1.0 in August.

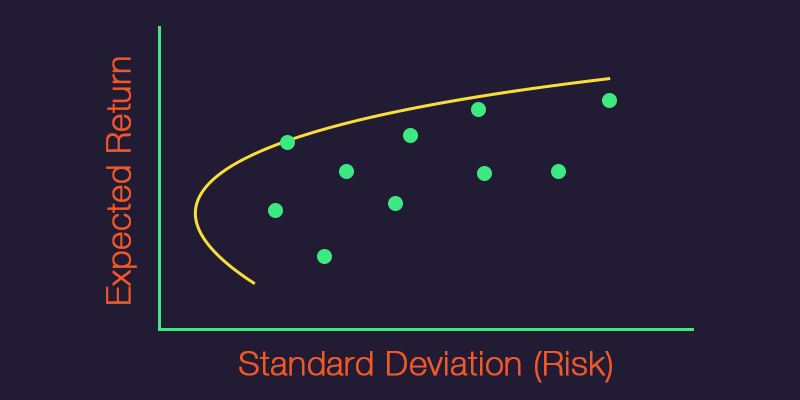

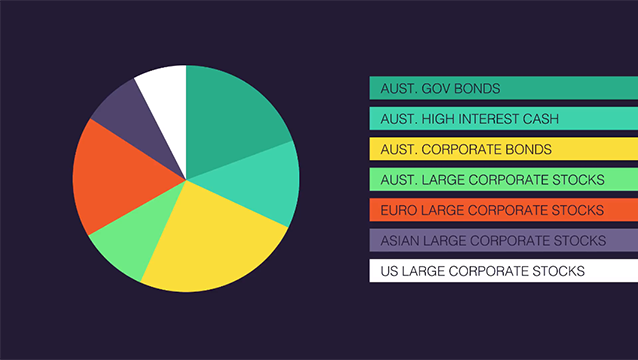

Secondly, investment committees around the world are having to make increasingly difficult decisions given the relative value of equities to cash and bonds and illiquid assets like property. Each investment committee will come to a different conclusion, but with cash rates expected to fall by two more cuts this year in the US, and many government bonds globally trading at negative rates it is a difficult decision where to allocate the cash once you sell out of equities. It is possible for this reason that equities will remain at record levels.

Trump open to temporary China trade deal

Turning to the US, this week saw the Trump administration announce it was considering a “temporary” trade deal with China. Markets have been fixated on the trade war for much of 2019 and rising hopes for a deal have boosted risk appetite and expectations for global growth. Rallies in the Euro and emerging market currencies show just how much the market is focused on the ongoing trade stoush.

However, even if a temporary trade deal is stuck, there is no sign that the US and China are any closer to bridging their fundamental differences. Indeed, it is my view that the trade dispute could escalate further in the future. Given that, and with global growth likely to remain weak more generally, I still expect riskier assets to come under pressure soon – but I have been wrong so far.

US consumer prices tick up in August

Still in the US, this week saw the core CPI inflation rate there rise 0.3 per cent to an 11-year high of 2.4 per cent in August. The US Federal Reserve has worried that inflation has been rising too slowly, citing this issue as one of the reasons it cut interest rates in July. The August data is very unlikely to stop the Fed from cutting interest rates again next week.

Meanwhile, US retail sales data showed that underlying sales growth is slowing but still growing, pointing to Q3 consumption growth still likely to be above 3 per cent annualised and overall GDP growth coming in at about 2 per cent annualised.

There was also a small rebound in the University of Michigan consumer confidence index. It rose to 92 in September from 89.8 in August, providing further reassurance that a severe consumer-led downturn is unlikely.

____________________

Important Note: The information on this website is provided for the use of licensed financial advisers only. The information is general advice and does not take into account any person’s particular investment objectives, financial situation or investment needs. If you are an investor, you should consult your licensed adviser before acting on any information contained in this website.

Investors only: The information in this Document is confidential it must not be reproduced, distributed or disclosed to any other person unless it is part of their statement of advice. The information may be based on assumptions or market conditions and may change without notice. This may impact the accuracy of the information. In no circumstances is the information in this Document to be used by, or presented to, a person for the purposes of making a decision about a financial product or class of products.

General advice warning: The information contained in this Document is general information only. It has been prepared without taking account any potential investors’ financial situation, objectives or needs and the appropriateness of this information needs to be considered in that context. No responsibility or liability is accepted by Instreet or any third party who has contributed to this Document for any of the information contained herein or for any action taken by you or any of your officers, employees, agents or associates.