By Alison Banney from Finder.com.au

By Alison Banney from Finder.com.au

Have you considered dabbling in the share market, but there are a few thoughts you can’t get out of your head telling you that you shouldn’t? Maybe you think you don’t have enough money, or perhaps you keep hearing that you’re too young to be investing in shares (shares are for old people, right?).

Well, you’ll be glad to learn that most of these myths surrounding investing are just that – myths. Here are five common misconceptions that you shouldn’t let deter you from getting cracking in the share market.

1. “I don’t have enough money.”

A lot of people think you can only invest in the share market if you’re loaded. This is far from true, and you can actually start investing in the share market for as little as $5.

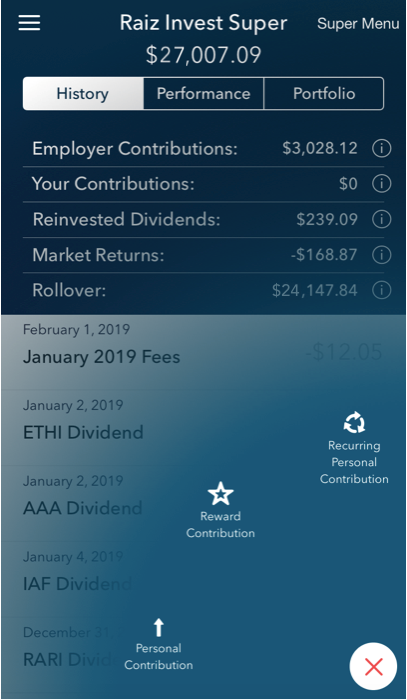

Most online share trading brokers require you to invest at least $500 per trade on the Australian Securities Exchange (ASX), which compared to a property deposit, is a really low entry point. But if you use a micro-investment app like Raiz, you can get started with even less.

2. “It can wait until I’m older.”

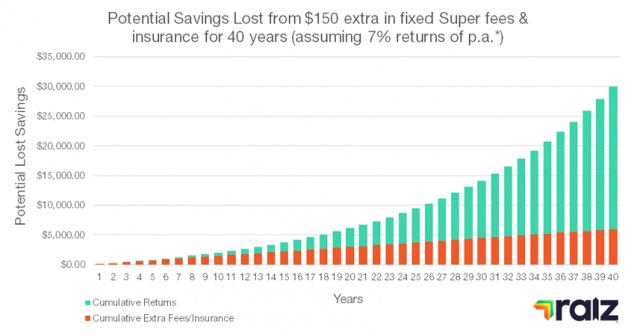

The thing with investing in the share market is that it’s a long-term play. It’s not a way to get rich overnight. The longer you’re invested, the more opportunity you have for your portfolio to grow in value.

A common expression in the industry is that it’s all about time in the market, not timing the market. So rather than waiting until you’re older and trying to pick a winning stock, it’s a much better strategy to start while you’re young, invest in a well-diversified portfolio and let the market do its thing.

3. “I don’t know enough about the share market.”

The good news here is that you don’t need to know too much about the share market to start investing. You might have memories of your parents researching the performance of different stocks in the weekend newspaper and carefully handpicking which ones to invest in. But this isn’t the case anymore.

Thanks to products called exchange traded funds (ETFs), you don’t have to worry about handpicking single stocks to buy. ETFs track the performance of a whole bunch of underlying shares, giving you the chance to access a large bundle of companies in one single investment that’s managed on your behalf.

4. “It’s too risky for me while I’m young.”

It’s easy to understand why a lot of young people think share trading is too risky. You’re right, shares are a high-risk asset. But the funny thing is, share trading actually becomes more and more risky the older you get.

When you’re young, you have your whole working life to ride out any volatility in the share market. So even if there’s a dip or a bigger correction in the market and your shares fall in value, you have plenty of time for them to build themselves back up again. However, if you’re older and closer to retirement, you need to be focused on protecting your nest egg. If you’re in your 60s and there’s a crash in the market, you might not have enough time left to build your portfolio back up again.

5. “I should be saving for a house deposit instead”

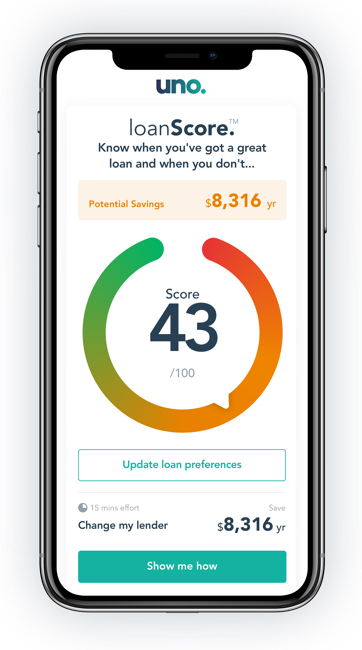

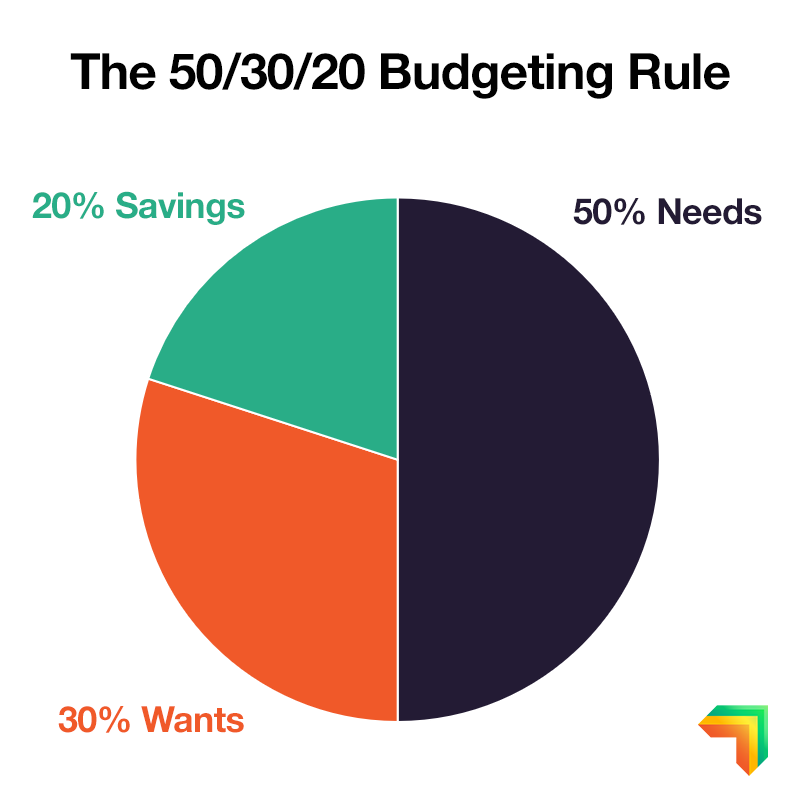

There’s no reason you can’t invest in shares and save for a house deposit at the same time. You don’t need to put your entire life savings into the share market, but putting a percentage of your savings in shares while the rest stays tucked away in a high interest savings account could be a good strategy to build wealth.

It’s also good to remember that shares are generally considered a liquid asset, meaning they can easily be sold if you want to cash out, and you won’t be stuck holding them while you wait for an interested buyer. So if you do want to sell you shares when you’re ready to buy a home, it’s simple and quick to do so.

Don’t have the Raiz App?

Download it for free in the App store or the Webapp below:

Important Information

The information on this website is general advice only. This means it does not take into account any person’s particular investment objectives, financial situation or investment needs. If you are an investor, you should consult your licensed adviser before acting on any information contained in this article to fully understand the benefits and risk associated with the product.

A Product Disclosure Statement for Raiz Invest and/or Raiz Invest Super are available on the Raiz Invest website and App. A person must read and consider the Product Disclosure Statement in deciding whether, or not, to acquire and continue to hold interests in the product. The risks of investing in this product are fully set out in the Product Disclosure Statement and include the risks that would ordinarily apply to investing.

The information may be based on assumptions or market conditions which change without notice. This could impact the accuracy of the information.

Under no circumstances is the information to be used by, or presented to, a person for the purposes of deciding about investing in Raiz Invest or Raiz Invest Super.

Past return performance of the Raiz products should not be relied on for making a decision to invest in a Raiz product and is not a good predictor of future performance.