29-03-2021

George Lucas, Raiz Group CEO

Last week marks one year since global equities bottomed out as a result of the COVID-19 virus that sent severe shocks through financial markets as it moved from China to nations in the West.

29-03-2021

George Lucas, Raiz Group CEO

Last week marks one year since global equities bottomed out as a result of the COVID-19 virus that sent severe shocks through financial markets as it moved from China to nations in the West.

Understanding how home loans work in Australia and trying to navigate all the terminology can be tough, but for first home buyers it can be overwhelming.

It is hard to believe it has been a year since the equity markets were plunged into the crisis of COVID-19, reaching lows on March 23rd, 2020. But since then, markets have not only survived, they have thrived.

Buying your first home can be a daunting experience, but did you know that both the Federal and various State Governments have schemes to assist first home buyers?

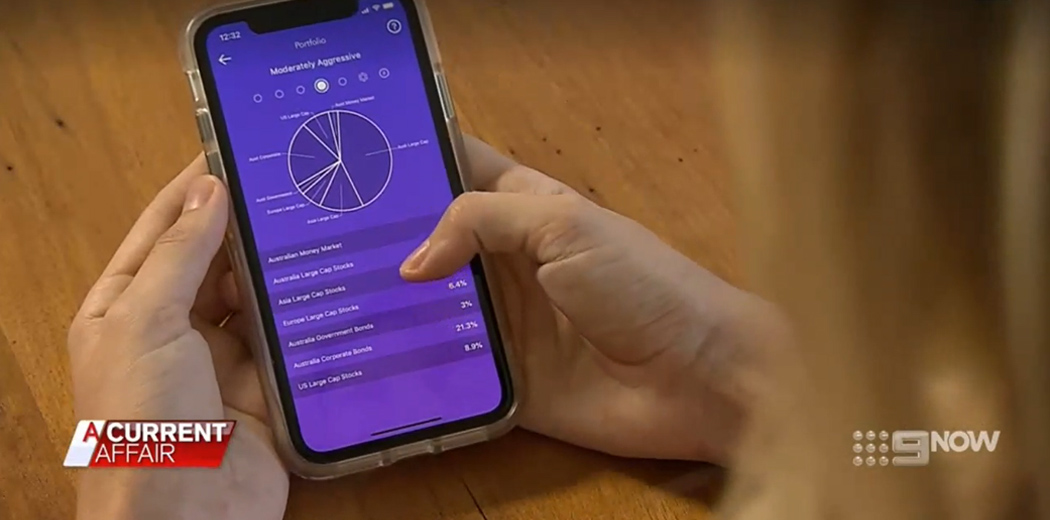

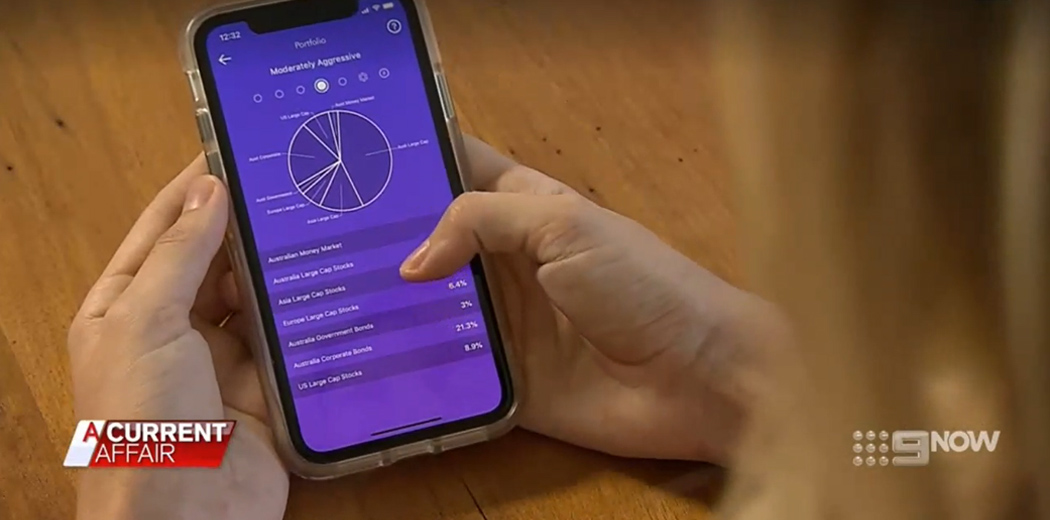

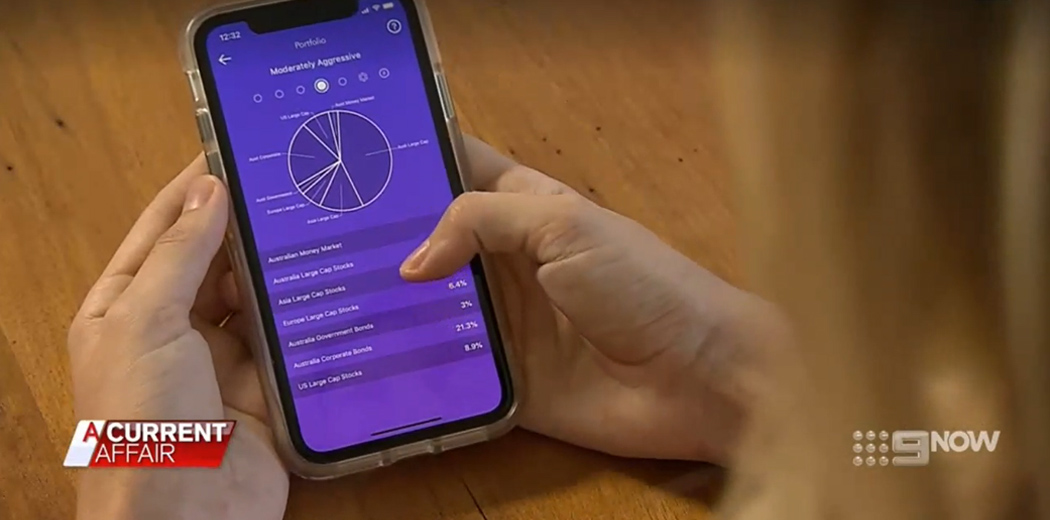

In case you missed it, Raiz Invest Australia’s CEO, Brendan Malone, was recently featured on Channel Nine’s A Current Affair (ACA) describing the features that everyday Australians have come to know and love when it comes to the easy-to-use Raiz App.

16-03-2021

George Lucas, Raiz Group CEO

It wasn’t the most eventful week in markets. The US Treasury bonds continued their selloff on the back of US President Joe Biden pushing through his $1.9 trillion economic stimulus plan and the news that the US vaccination program against COVID-19 will be accelerated.

You may have seen the eye-watering prices being thrown around on the internet for digital art, video clips, animations, and even memes. A few days ago someone bought a digital video by Beeple for $6.6 million. Why would anyone pay such large amounts for items they can view for free on the internet? The answer lies with the recent explosion in popularity of digital tokens, known as non-fungible tokens (NFTs).

Some of the biggest rewards of this year are now live for our first ever March Madness! For 2 days only (March 11-12), many of your favourite brands have decided to give Raiz customers exclusive boosted rewards.

Do you know what types of life insurance you already have – and how much you may need, if any?

According to a recent study by research firm Rice Warner, the average level of life insurance Australians have is around half the amount they need to be financially secure.[1] So that means many Australians may be underinsured compared to their expected level.

It is fast approaching that time of the quarter… dividend time! Let’s see what this could mean for you and some of the ETFs available in the Raiz Portfolios.