Investing into an ETF and how do ETFs differ?

The

Raiz philosophy is to invest small amounts regularly, no matter the market

condition, as this strategy can minimise the risk of investing in markets and

we believe is one of the keys to having a healthier balance over the long run.

All

your investments, whether it be your spare change from round-ups, lump sums or

recurring deposits, are invested into one of the 6 diversified portfolios that

were constructed with help from the Nobel Prize winning economist and father of

Modern Portfolio Theory, Dr. Harry Markowitz.

What

is a diversified portfolio?

To

find the right balance between risk and reward, your money is never invested

into one specific share or company. It is instead invested across a bundle of

shares or bonds that form one financial product, called an Exchange Traded Fund

(ETF).

The

Raiz portfolios are made up of a combination of different ETFs that range from

cash, bonds, Australian and international shares. Every investment you make

will be allocated towards these ETFs. For more information on Raiz fees, click here.

Watch our video on – How our Raiz Portfolios are built

Let’s

take a deeper look into these ETFs:

The

first six are called ‘Large Cap Stocks’

1. Australia

Large Cap Stocks (ASX:STW)

2. Asia

Large Cap Stocks (ASX:IAA)

3. Europe

Large Cap Stocks (ASX:IEU)

4. US

Large Cap Stocks (ASX:IVV)

5. Australia

Social Responsible Large Cap (ASX:RARI)

6. Global

Socially Responsible Large Cap (ASX:ETHI)

What

are large cap stocks?

Large

cap stocks are the biggest companies on their respective country’s stock

exchange in terms of market capitalisation – or total dollar value of a

company. Companies that fall in this category tend to be in established

industries and are major players in their field. Large cap stocks can be a

safer option as their earnings may be more consistent than less-established

companies, making them more likely to show returns over time.

Examples

of Large Cap stocks that your investments can go towards are international

shares such as Apple, Google & Microsoft and Australian shares such as

Telstra, Westpac & Woolworths.

You

can also see all the hundreds of companies that make up these ETFs by searching

for the ETF code or the provider from our product disclosure statement.

7. Australia

Government Bonds (ASX:IAF)

Australia

Government bonds are viewed as more secured and as less risky investment

products than large cap stocks. It differs to stocks as you are instead

essentially lending money to the government at an agreed interest rate. The

government will then pay the interest and return the money that was lent at

maturity. Rather than hold a bond to maturity though, they can also

be traded. The risk is therefore tied to the ability of the Australian

Government to pay you back both the interest and the money that was lent at the

end.

8. Australia

Corporate Bonds (ASX:RCB)

Similar

to government bonds, corporate bonds are a way for Australian companies to

raise money, by borrowing from you. The business will pay the interest and

return the money lent. It can also be traded on an exchange before maturity.

The risk is again therefore tied to the ability of the Corporate to pay you

back both the interest and the money that was lent at the end.

9. Australian

Money Market (ASX:AAA)

This

ETF is invested into the money market, which has the least volatility. The fund

focuses on investing in term deposits and high interest accounts

offered by banks in Australia. As these tend to be short dated, the risk

that a bank cannot repay both the interest and the money back is low.

What

are the allocations for the ETFs?

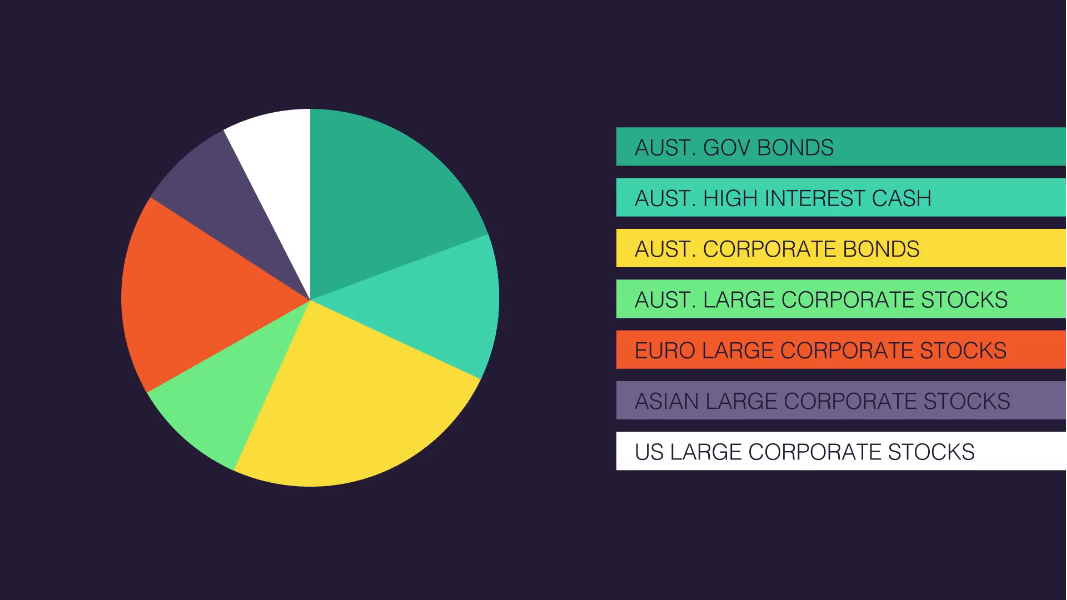

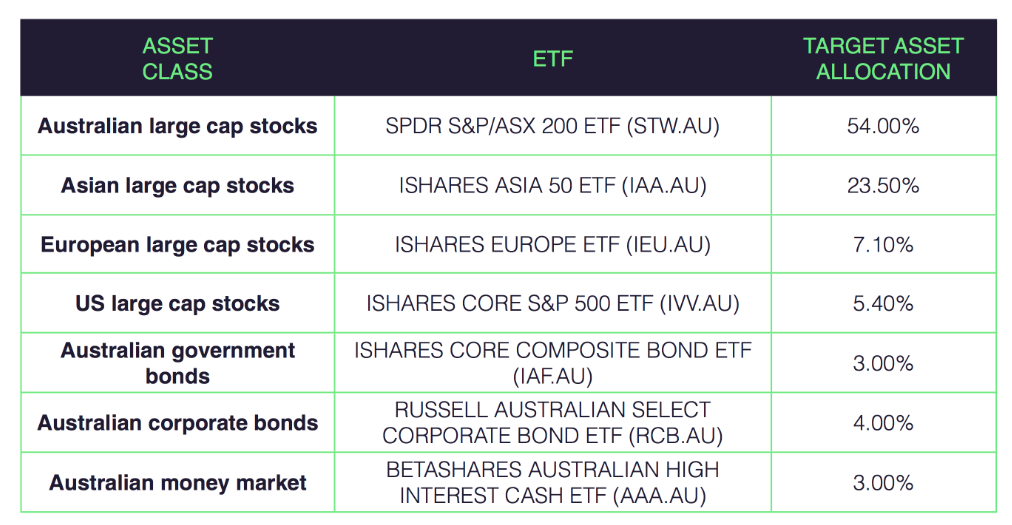

We

invest your money in a combination of the above ETFs on a sliding scale

depending on how aggressive or conservative you want to be with your

investments. Conservative portfolios will have a bigger allocation in bonds

& cash, while the more aggressive portfolios will have a bigger allocation

in Australian and international shares.

You

will be able to find the exact allocations that makes up your portfolio in

our product disclosure statement.

Example

of allocation for the Aggressive portfolio:

How

can I keep track?

The

Raiz app will give you the daily, monthly and yearly performance of your

portfolio. You are also able to keep track of the individual ETF’s performance

yourself through the web or via a stock app. Keep in mind though, markets go up

and markets go down. Therefore, it is important to look at the long-term big

picture and not the daily fluctuations. You can find more in our blog, The Advantages of Dollar Cost Averaging

Don’t have the Raiz App?

Download it for free in the App store or the Webapp below:

Important Information

The information on this website is general advice only. This means it does not take into account any person’s particular investment objectives, financial situation or investment needs. If you are an investor, you should consult your licensed adviser before acting on any information contained in this article to fully understand the benefits and risk associated with the product.

A Product Disclosure Statement for Raiz Invest and/or Raiz Invest Super are available on the Raiz Invest website and App. A person must read and consider the Product Disclosure Statement in deciding whether, or not, to acquire and continue to hold interests in the product. The risks of investing in this product are fully set out in the Product Disclosure Statement and include the risks that would ordinarily apply to investing.

The information may be based on assumptions or market conditions which change without notice. This could impact the accuracy of the information.

Under no circumstances is the information to be used by, or presented to, a person for the purposes of deciding about investing in Raiz Invest or Raiz Invest Super.

Past return performance of the Raiz products should not be relied on for making a decision to invest in a Raiz product and is not a good predictor of future performance.