What is the IVV ETF at Raiz?

iShares Core S&P500 ETF (ASX:IVV)

The USA, a larger-than-life nation where dreams and fortunes have been made and are still made today. It is home to some of the biggest companies, stock markets and stock indices on the planet.

One of the most widely followed indices globally that is used to gauge the performance of the US stock market is the Standard and Poor’s 500 Index, otherwise known as the S&P500 Index. IVV is an ETF quoted in Australia that tracks the performance of this index.

What is an ETF?

An ETF is a Fund that is traded on an exchange – an Exchange Traded Fund (ETF). At Raiz we invest in ETFs quoted on the ASX, the biggest stock exchange in Australia. Read our ETF blog here to help get you up to speed.

What is the IVV ETF?

The IVV ETF is an Australian listed ETF issued by iShares that tracks the performance of the S&P500 Index, featuring many of the 500 biggest companies in the USA. iShares is owned by BlackRock, the world’s largest ETF issuer. Think Apple, Microsoft, Meta, Tesla. It’s a long and prestigious list of many globally recognisable brands that you can track with one single ETF.

You can view the US quoted IVV factsheet here and the Australian quoted ETF here.

Some interesting facts about the S&P500 Index

- Although there are 500 companies making up the index, as of December 31st, 2021, there are actually 508 listings in the S&P500, not 500 as some may expect. This is because companies such as Alphabet have issued multiple classes of shares.

- It is one of the most tracked indices worldwide, with more than US$5.4 Trillion invested assets tied to the performance of the index, including the IVV ETF! The ETF industry is now US$10 Trillion. That’s big.

- As of January 12th, 2022, the top 5 companies accounted for 20.6% of the value of the entire index. These companies are listed below.

- To join the S&P500 Index, a stock must meet a broad set of criteria, including having a total market value of at least $11.8 billion as of the end of 2021, and have had four consecutive quarters of profit. Companies that deviate from the criteria set may be removed from the S&P500 Index, which rebalances quarterly.

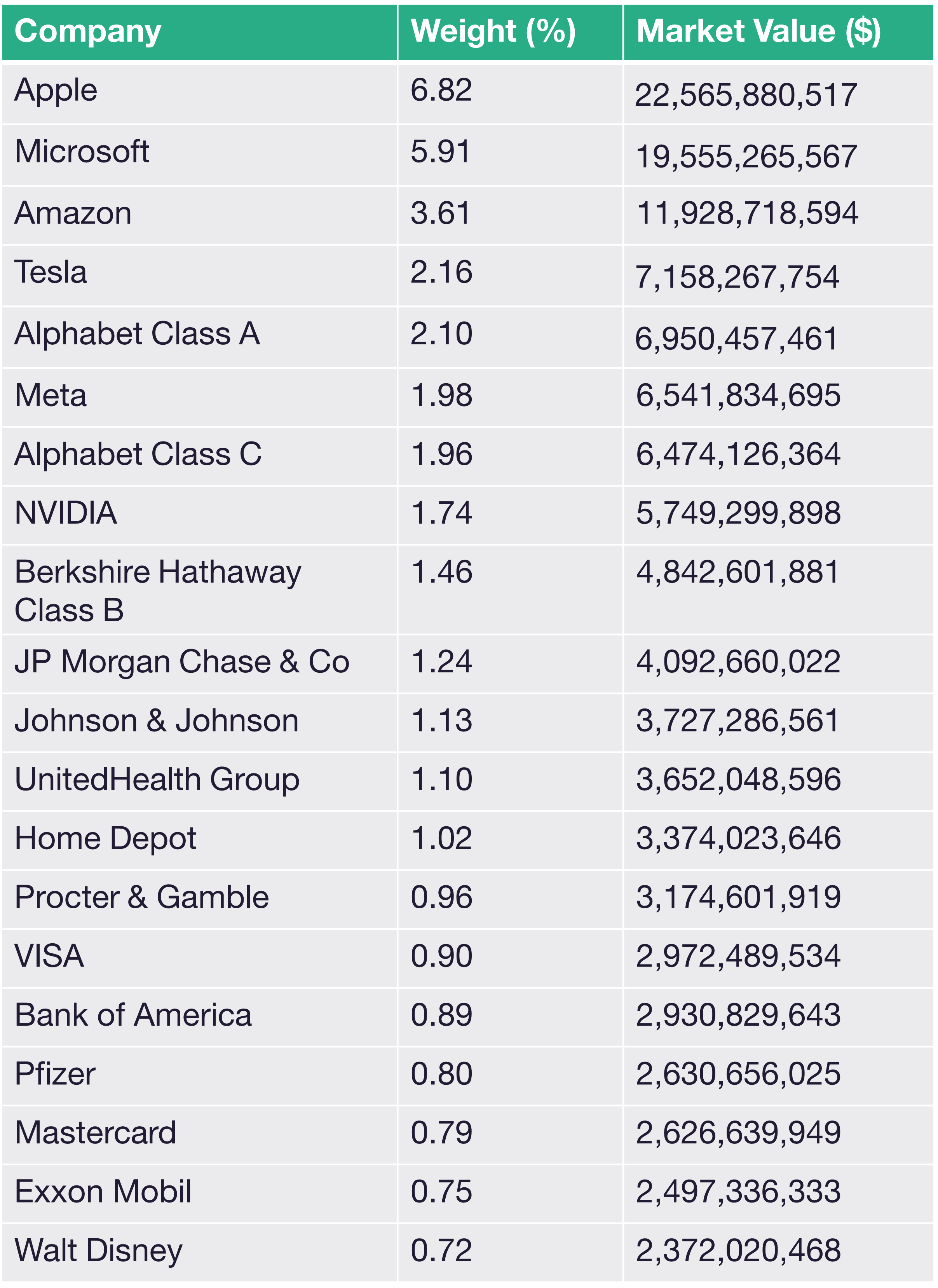

Top 20 Stocks in the IVV ETF (as of Jan 12th, 2022)

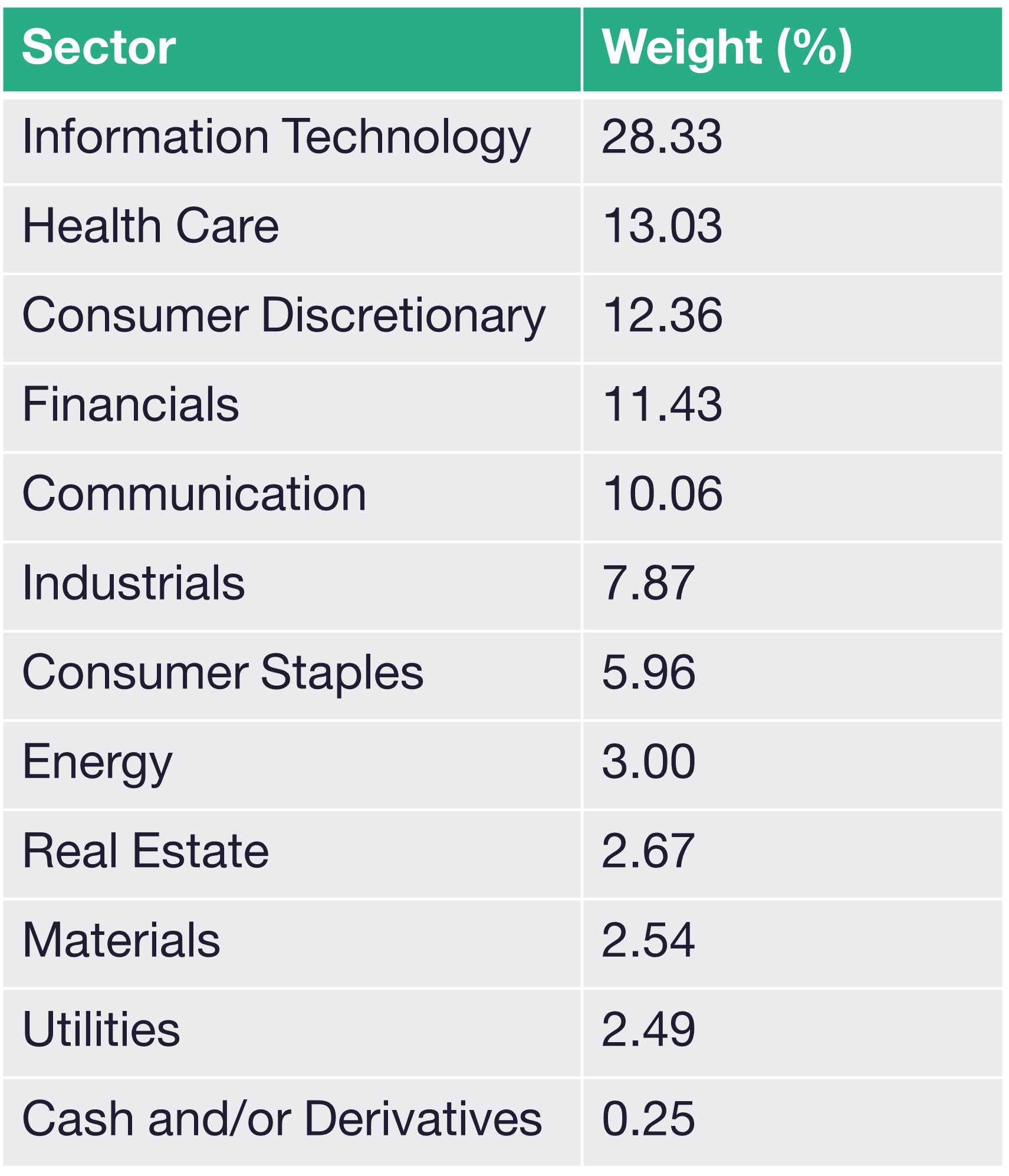

Sector breakdown of IVV (as of Jan 12th, 2022)

How can I own an ETF if the index is based in the US?

The issuer, iShares, buys the correct proportions of the shares to represent the S&P500 Index, but the ETF is quoted and traded here in Australia on the ASX. ETFs at Raiz like IVV can enable you to have exposure to markets across the world. This is not currency hedged so is exposed to US Dollar movements against the Australian Dollar.

Does the ETF move if the S&P500 Index moves?

During ASX opening hours, the movement in the IVV ETF should approximately correspond to the movement in S&P500 futures that trade almost 24 hours a day. The physical stocks that make up the S&P500 Index are actually closed on the main US exchanges when IVV in Australia is open because of the time difference, but the S&P500 futures provide a good indicator of where the S&P500 Index is being valued by investors in real time.

There is no currency hedging. So if the S&P500 index rises 1% but the AUD rises 1% the change in value of IVV will be close to 0%. But this also means that the value of IVV can rise if the AUD falls.

The good news?

IVV is available in seven of the Raiz Portfolios – just not in Emerald Portfolio.

To see Raiz fees, click here.

To see if Raiz is suitable for you, please read the PDS.

Don’t have the Raiz App?

Download it for free in the App store or the Webapp below:

Important Information

If you have read all or any part of our email, website, or communication then you need to know that this is factual information and general advice only. This means it does not consider any person’s particular financial objectives, financial situation, or financial needs. If you are an investor, you should consult a licensed adviser before acting on any information to fully understand the benefits and risk associated with the product. This is your call but that is what you should do.

You may be surprised to learn that RAIZ Invest Australia Limited (ABN 26 604 402 815) (Raiz), an authorised representative AFSL 434776 prepared this information.

We are not allowed, and have not prepared this information to offer financial product advice or a recommendation in relation to any investments or securities. If we did give you personal advice, which we did not, then the use of the Raiz App would be a lot more expensive than the current pricing – sorry but true. You therefore should not rely on this information to make investment decisions, because it was not about you for once, and unfortunately, we cannot advise you on who or what you can rely on – again sorry.

A Product Disclosure Statement (PDS) for Raiz Invest and/or Raiz Invest Super is available on the Raiz Invest website and App. A person must read and consider the PDS before deciding whether, or not, to acquire and/or continue to hold interests in the financial product. We know and ASIC research shows that you probably won’t, but we want you to, and we encourage you to read the PDS so you know exactly what the product does, its risks and costs. If you don’t read the PDS, it’s a bit like flying blind. Probably not a good idea.

The risks and fees for investing are fully set out in the PDS and include the risks that would ordinarily apply to investing. You should note, as illustrated by the global financial crisis of 2008, that sometimes not even professionals in the financial services sector understand the ordinary risks of investing – because by their nature many risks are unknown – but you still need to give it a go and try to understand the risks set out in the PDS.

Any returns shown or implied are not forecasts and are not reliable guides or predictors of future performance. Those of you who cannot afford financial advice may be considering ignoring this statement, but please don’t, it is so true.

Under no circumstance is the information to be used by, or presented to, a person for the purposes of deciding about investing in Raiz Invest or Raiz Invest Super.

This information may be based on assumptions or market conditions which change without notice and have not been independently verified. Basically, this says nothing stays the same for long in financial markets (or even in life for that matter) and we are sorry. We try, but we can’t promise that the information is accurate, or stays accurate.

Any opinions or information expressed are subject to change without notice; that’s just the way we roll.

The bundll and superbundll products are provided by FlexiCards Australia Pty Ltd ABN 31 099 651 877 Australian credit licence number 247415. Bundll, snooze and superbundll are trademarks of Flexirent Capital Pty Ltd, a subsidiary of FlexiGroup Limited. Lots of names, which basically you aren’t allowed to reproduce without their permission and we need to include here.

Mastercard is a registered trademark and the circles design is a trademark of Mastercard International Incorporated.

Home loans are subject to approval from the lending institution and Raiz Home Ownership makes no warranties as to the success of an application until all relevant information has been provided.

Raiz Home Ownership Pty Ltd (ABN 14 645 876 937), an Australian Credit Representative number 528594 under Australian Credit Licence number 387025. Raiz Home Ownership Pty Ltd is 100% owned by Raiz Invest Australia Limited (ABN 26 604 402 815).