Investing isn’t just for financy pants

By Clayton Daniel of Fund Your Ideal Lifestyle

I

remember over a decade ago when I didn’t know anything about investing. It’s a

really good frame of reference to have, and one that I hope I never lose.

Because

investing can seem ten million times more complex than it really is. Why? Well,

money is an emotional topic, and the first time you do anything it seems hard.

So

with that in mind, I wanted to explain all the financy pants terms that get

thrown around, and give some explanation as to where all the pieces of the

puzzle fit in. I think the more you understand about where you are investing,

and what you are investing in, the more control you will feel, and ultimately

the more comfort.

So

here we go.

Starting

right at the top we have the ever-ethereal word ‘market’. This word gets

thrown around a fair bit. It basically means the same as it always has. A place

where people gather to buy and sell. But instead of buying and selling fish or

bread, they are buying and selling assets like property or equities.

So

when something is traded on the market, it really means it is traded in a place

where there are buyers and sellers. If an asset has a market price, it simply

means the price is at a point between where buyers want to buy and sellers want

to sell.

Now

let’s talk about the most common type of asset traded on the market – an equity.

An equity is called as such as when you own it, you own equity in a company.

You own a part of the company. Equities have the remarkable distinction of

being able to interchange their name at any given moment. Have you ever heard

the terms ‘shares’ or ‘stocks’. Yeah, same thing.

At

this stage, now you know that equities are traded on the equity market (or

shares/stocks are traded on the share/stock market). This is where you can buy

and sell blue chip shares like the big four banks, or speculative mining

shares. There are thousands of different stocks to trade on the stock market.

The only limits are your limits to research and what equities you are

comfortable in buying.

Okay,

so that’s great right? You can go out right now and start investing. Fantastic.

What are you going to buy? If you are an investment professional, you will have

an investment philosophy that works for you. If you are not an investment

professional, you probably don’t have an investment philosophy.

Therefore

you can either spend a lot of time researching to become an investment

professional, you can hire an investment professional for you, or you can buy

what’s called an Exchange-Traded Fund (ETF). An ETF is simply

a computer algorithm that invests your money into equities. The benefit is, for

every change to the portfolio you aren’t charged a fee. Instead, you pay an

ongoing percentage fee to cover the management of your portfolio. This reduces

the conflict of ‘churning’ investments which is the natural result of a

business model where revenue is made through the amount of buy/sells that are

made.

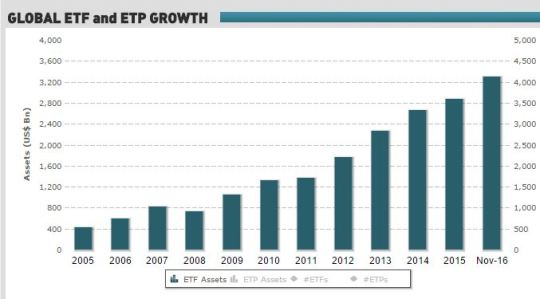

As

you can see above, the amount of global money invested in ETF’s has grown

significantly since the start of the Global Financial Crisis (GFC) in 2007. So

why has the ETF market grown by 400% in less than a decade? Well for a few

reasons.

Firstly,

investors were burned so bad during the GFC that they got sick of paying for

stockbrokers, financial advisers, and fund managers to invest their money. The

argument that people were better at picking equities than computers were

largely proven wrong.

This

in turn created the rise in Modern Portfolio Theory. Put basically, you get 80%

of your gains and losses simply by being in the market. There are easily

refutable points to this theory, but put simply, it provided a framework to

build a portfolio without human involvement.

Which

brings me to technology. The technology to build these trading algorithms have

improved like all other tech has improved over the decades. These days there

are many different types of ETF’s, though most the money is still in the easy

to understand simple ones.

As

always, price is very important. Some ETF’s are so unbelievably cheap that it’s

hard to see where the revenue is being made by the product issuer. Some ETF’s

are so cost effective that on a million-dollar portfolio you can pay as little

as $300 a year.

And

with all these benefits it drew in many investors, which in turn created more

awareness, and more education. To the point where now ETF’s are essentially the

most popular way to invest. And considering the points above, it’s not hard to

see why.

Now

you know how to invest in the market, by purchasing equities through an ETF.

Brilliant. You’re nearly there. So how do you do all this? How do you pick

which broker to use, and which ETF’s to invest in. Well again, you can either

learn to do it yourself, hire someone to do it for you, or use technology.

This

brings me to the last piece of financy pants education today. The technology to

make all this happen – Raiz. Raiz is simply an app which takes the small amount

of round ups on purchases you make in everyday life, and invests them for you

into ETFs.

Raiz

themselves don’t have anything to do with the ups and downs of the market. They

simply make easy what has typically been hard to do – open an account and start

investing. They take the manual work out of starting a brokerage account, and

choosing which ETF’s to invest into.

They

take all the complexities out of investing, and make it as easy as buying your

daily coffee. And that to me is brilliant. As a personal finance expert, the

ease in which they make investing is unbelievable. Raiz are the packaging to

make investing easy for the every day person.

So

to recap: You invest in the market, by purchasing shares, with an ETF, through

the Raiz app. For more information on Raiz fees, click here.

Look

at you – all financy pants…..

By

Clayton Daniel of Fund Your Ideal Lifestyle

Don’t have the Raiz App?

Download it for free in the App store or the Webapp below:

Important Information

The information on this website is general advice only. This means it does not take into account any person’s particular investment objectives, financial situation or investment needs. If you are an investor, you should consult your licensed adviser before acting on any information contained in this article to fully understand the benefits and risk associated with the product.

A Product Disclosure Statement for Raiz Invest and/or Raiz Invest Super are available on the Raiz Invest website and App. A person must read and consider the Product Disclosure Statement in deciding whether, or not, to acquire and continue to hold interests in the product. The risks of investing in this product are fully set out in the Product Disclosure Statement and include the risks that would ordinarily apply to investing.

The information may be based on assumptions or market conditions which change without notice. This could impact the accuracy of the information.

Under no circumstances is the information to be used by, or presented to, a person for the purposes of deciding about investing in Raiz Invest or Raiz Invest Super.

Past return performance of the Raiz products should not be relied on for making a decision to invest in a Raiz product and is not a good predictor of future performance.