Investing is easy with Raiz

We have all made changes to our everyday lives out of necessity or choice because of the COVID-19 pandemic. It has touched each and every one of us, affecting where and indeed if we are working, how we connect and stay in touch with our families and friends, how we exercise, and how we shop.

However, when it comes to finances, COVID-19 has affected people very differently.

There has been a growing number of unemployed. The tourism, hospitality and retail sectors have been particularly hard hit, and are industries that traditionally have a higher proportion of millennials and females in their workforce, who are needing to draw down on typically minimal savings to meet their everyday financial obligations.

Many households have been fortunate enough to have the same income as before, yet the restrictions enforced upon them have reduced their expenditure, meaning more disposable income and an opportunity to pay down debt and increase savings.

Meanwhile, some fortunate individuals are financially better off in terms of income than before the virus due to the various Government stimulus payments they have received over recent months.

The effects of COVID-19 have also been felt on the financial markets, and Australia entered its first recession in nearly 30 years. So, it is hardly surprising that many people are now taking a moment to assess their current financial situation and work out their financial strategy for the months ahead.

In times of uncertainty, it is tempting to change your strategy.

So, what is the right move when it comes to investing through the current market fluctuations? Well, there is no right or wrong answer. It’s all down to what is right for you, your personal circumstances, and more importantly what you feel comfortable with.

The thing to keep in mind is that whatever you decide, the Raiz app makes it incredibly easy and inexpensive for you to implement buy and sell decisions and supports you in achieving your investment goals. For more information on Raiz fees, click here.

How to make an investment into the market with Raiz

Once you have your account set up and have selected your portfolio, there are 3 easy ways to make an investment into the market

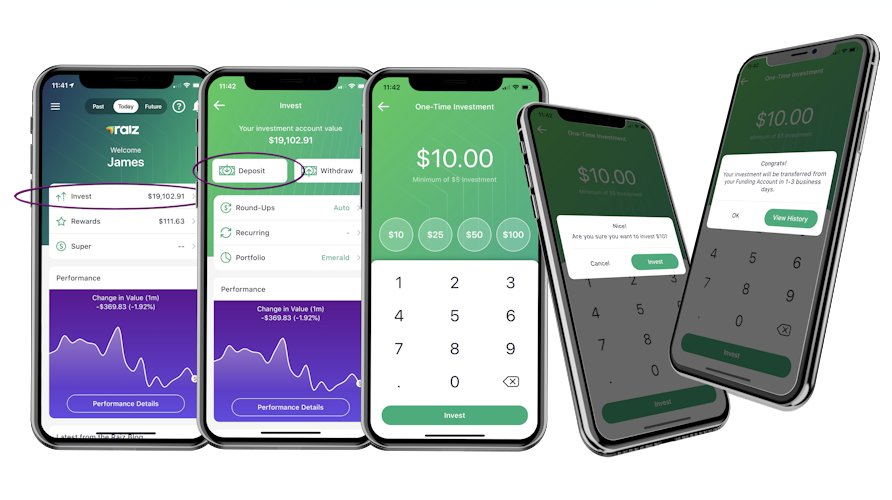

One-Time Investment

You can invest a single lump sum into your Raiz account at any time. Simply click on Invest > Deposit from the Welcome screen. You can use the ‘quick invest’ buttons, or enter your own amount up to $10,000, then confirm your investment.

Round-Ups

A “round-up” allows investments to happen automatically, in the background of your life, like super. Round-Ups is the virtual spare change captured from rounding up your transaction to the nearest dollar. When you link your bank accounts to your Raiz account, we track the spare change from your transactions you make via internet banking and the credit/debit cards linked to those bank accounts, and make it available for you to invest.

The Raiz App allows you to fully automate the process to make regular investing easier. To enable Round-Up’s simply click on Invest > Round-Ups from the Welcome screen, then on the Configuration icon in the top right of the screen to add your Spending Accounts to be monitored. Clicking the Configuration icon again will allow you to configure your auto Round-Up settings.

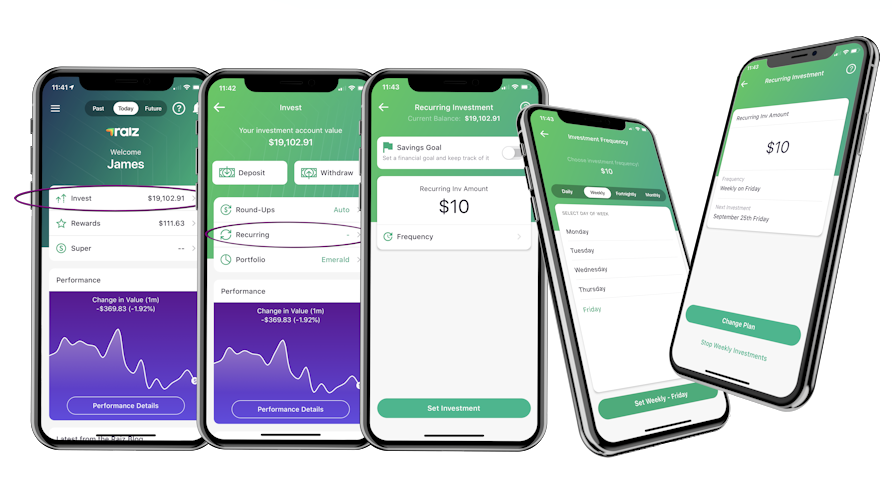

Recurring Investment

You can easily automate regular investments using the Raiz app. From the Welcome screen, click on Invest > Recurring. Simply choose your investment amount, select a frequency (daily, weekly, fortnightly or monthly), and when you want the investment to start. You can also set an optional Savings Goal if you are saving towards something specific and want help tracking your progress!

Regardless of whether you use One-Time, Recurring, or Round-up to make your investment, so long as the investment request is made within the app before our daily cut-off time (approx. 3:30pm Sydney Time, Mon-Fri), then funds will be taken from your linked Funding Account the same business day.

If your investment request is made after our daily cut-off time, or on an ASX non trading day (weekends and NSW Public Holidays), then funds will be taken from your linked Funding Account the following business day.

We invest your money into the market the business day after it has been taken from your Funding Account. Our trading window is 10am-12pm (Sydney Time, Mon-Fri) which is when your ‘buy’ price is locked in.

Once we have confirmation that shares have been successfully purchased on your behalf, your Raiz balance will update and reflect value of your portfolio include the new investment.

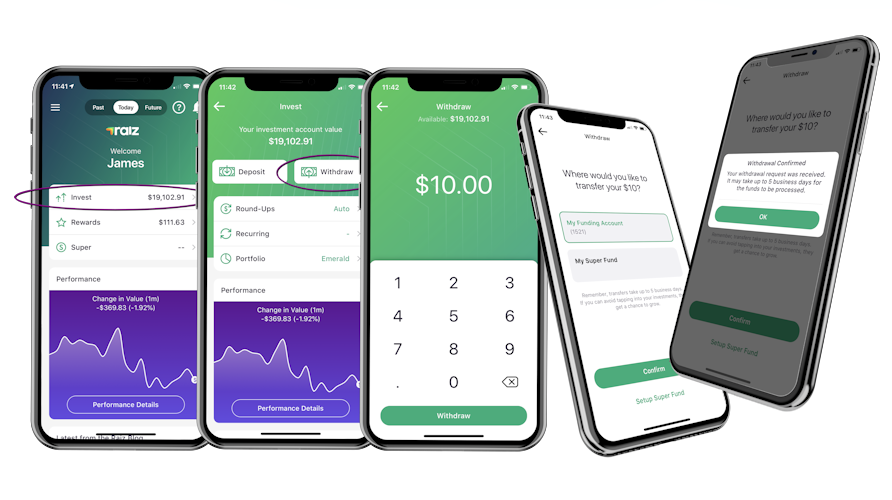

How to withdraw your investment

You can withdraw either all, or part of your investment from Raiz easily, at any time, with no penalty.

While you can create a withdrawal request 24/7 within the Raiz App, we can only action the sale of the investment when the stock market (ASX) is open.

If your withdrawal request is received after 9:30am, your investments will not be sold until the next business day. Our trading window is 10am-12pm (Sydney Time, Mon-Fri) which is when your ‘sell’ is locked in.

To make a withdrawal, from within the app is easy, simply click on Invest > Withdraw from the Welcome screen, enter the amount you wish to withdraw, and confirm.

When you sell shares in Australia, the ASX has a settlement transfer of two business days which means that the funds take two days after the sale to be released and received by Raiz. This applies to every person in Australia selling shares. See the ASX website for more details on this process.

When we receive the funds from the ASX after the two-day settlement period, we transfer the funds back to your bank account as soon as possible, so while the maximum wait time is up to 5 business days, it can usually take 3 or 4 (not including public holidays and weekends).

Don’t have the Raiz App?

Download it for free in the App store or the Webapp below:

Important Information

The information on this website is general advice only. This means it does not take into account any person’s particular investment objectives, financial situation or investment needs. If you are an investor, you should consult your licensed adviser before acting on any information contained in this article to fully understand the benefits and risk associated with the product.

A Product Disclosure Statement for Raiz Invest and/or Raiz Invest Super are available on the Raiz Invest website and App. A person must read and consider the Product Disclosure Statement in deciding whether, or not, to acquire and continue to hold interests in the product. The risks of investing in this product are fully set out in the Product Disclosure Statement and include the risks that would ordinarily apply to investing.

The information may be based on assumptions or market conditions which change without notice. This could impact the accuracy of the information.

Under no circumstances is the information to be used by, or presented to, a person for the purposes of deciding about investing in Raiz Invest or Raiz Invest Super.

Past return performance of the Raiz products should not be relied on for making a decision to invest in a Raiz product and is not a good predictor of future performance.