The Sneaky Money Trick That Fools Us All

You might not be into investments for any number of reasons. Maybe you don’t understand the vagaries of the markets and prefer to stay away from things you don’t understand. That’s perfectly understandable. Maybe you’re more into property, since “there’s no better investment than bricks and mortar.” Again, perfectly understandable.

But, I’m telling you right here and right now, if you’re in Australia (or most anywhere in the world), there’s an element of the investment markets that you simply CANNOT AFFORD TO IGNORE because you have a (in)vested interest in it.

This is something so simple and so basic that it’s almost invariably overlooked. And yet it takes just 5 minute to review it and see if you’re making a simple mistake that could end up costing you hundreds of thousands of dollars.

That’s right: fixing this one thing up – the one thing that I’m betting you haven’t looked at recently (because it’s tucked away in fine print on the statement that you barely look at, let alone understand (I’m just starting to get my head around it) – could literally save you hundreds of thousands of dollars.

Or put those dollars in your pocket.

Do I have your attention?

Good.

Now, what is it?

Your. Superannuation. Fees.

Really?

Yup, those measly 2% or 3% fees tucked away in a corner of your annual super statement, which, as we’ve established, you probably don’t read because those things are about as user-friendly it’s as if they were written in Arabic. Or Latin.

These fees can eat away at your retirement fund like a cancer, compounding and growing as your pot grows. And you’re (probably) letting it happen around you. So if you do one thing and one thing only in regard to anything I’ve ever written, it’s this:

See how much you are paying in fees and assess whether the fund manager deserves your money based on their performance.

Why This Matters?

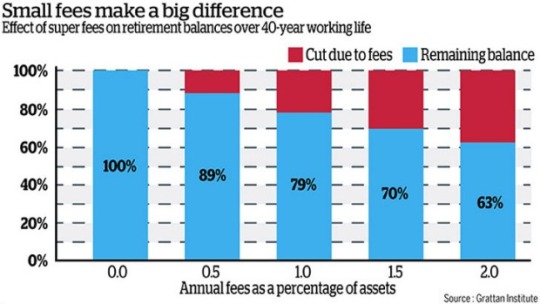

The illustration above makes it clear just how the fees can mount up if left unattended.

Assuming you (and your employer) have saved wisely for 40 years, your fund could end up being “worth” circa $1m. Except you’ve been paying an itty-bitty 2% annual management fee to your superannuation fund manager – regardless of their performance – so all you’re left with is $630,000.

The scoundrels have taken $370,000 in fees. Compare this $630K with the guy who has been paying 0.5% as an annual management fee. He’s left with a pot of $890,000. That’s 41% more at retirement (or $261,000). That’s a lot of cruises. A lot of pina coladas.

Worth checking out what you’re paying, huh?

You might be thinking that if your fund is performing well, returning maybe 8% per annum or more, then it’s worth paying a little extra in fees. You’re damn right, it might be. But, often it’s not.

High fees don’t always come with high returns. And if you end up accepting high fees for poor or average returns, well, you’re getting mugged off paying for schmick offices and coffee waiters.

Remember this: you can’t control how the market performs. But you can control the fees you pay and your approach to risk.

Your Task Now (yep, right now, don’t put it off)

Promise me this one thing. You’ll go and check the annual management fees you’re paying and take whatever action is necessary.

Important Information

The information on this website is general advice only. This means it does not consider any person’s investment objectives, financial situation or investment needs. If you are an investor, you should consult your licensed adviser before acting on any information contained in this article to fully understand the benefits and risk associated with the Raiz product.

The information in this website is confidential. It must not be reproduced, distributed or disclosed to any other person. The information is based on assumptions or market conditions which change without notice. This will impact the accuracy of the information.

Under no circumstances is the information to be used by, or presented to, a person for the purposes of deciding about investing in Raiz.

Past return performance of the Raiz product should not be relied on for deciding to invest in Raiz and is not a good predictor of future performance.