Any

marathon runner will tell you: You don’t think about all 42 kilometres at once.

That would be too overwhelming. Instead, picture the race in chunks: 5km, 10km,

or even one kilometre at a time. Manageable chunks.

This

same philosophy can be useful when saving for your post-work life,

especially when it’s still decades away. While the idea of saving $1

million may feel like a near-impossible feat, putting away just $150 or so

per month in your 20s seems completely reasonable—and that still may get you to

the million-dollar mark by retirement age, provided you’re disciplined, start

early and hit your “splits,” as runners would say.

Just

get started, save regularly, experience the power of compounding returns and

learn about market risks– and track your progress.

For

the sake of simplicity, let’s set aside inflation, fees, taxes and dividends.

Yes, those things are important, but it’s more important that you just get

started, save regularly, experience the power of compounding returns and learn

about market risks– and track your progress.

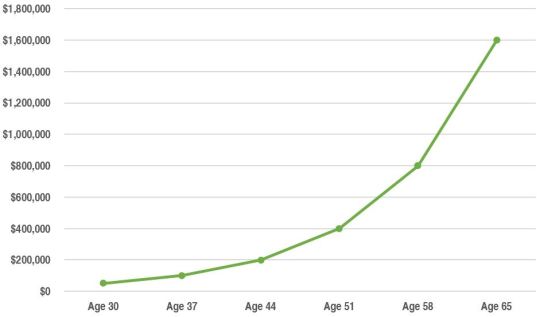

Here’s what this example could look like:

Okay, deep

breaths. I’m going to walk you through these targets, and explain why

they’re more reachable than you might think—and why, if you’ve hit 30 and

haven’t saved that much, it’s not too late.

The

first thing you’ll probably notice about this chart is that your money doubles

every seven years. I’m basing that on an investing concept known as the rule of 72, which says that if you earn 7.2

percent interest annually your money doubles in 10 years. Roughly, the reverse

is true, as well: If you earn 10 percent on your money, it doubles in 7.2

years.

You

also likely noticed that the larger you’re starting point in each doubling

cycle, the larger the growth….That means the most important consideration is

starting the doubling clock.

For

the milestones listed above to work, you’ll likely need growth from both equity

market returns (say, 7 percent) and additional cash saved (3

percent). Any percentage variation works—bigger investment returns, less cash

added; more cash added, smaller returns—so long as you get to about 10 percent,

your money will double every seven years or so.

You

also likely noticed that the larger you’re starting point in each doubling

cycle, the larger the growth. Under the example above, the balances really

start to grow—to $200,000, $400,000 and beyond—during your 40s and 50s. That

means the most important consideration is starting the doubling clock. If

you embarked on this particular milestone chart at 37 instead of 30, for

example, you may be missing $800,000 by retirement age.

Now,

let’s talk through my assumptions, and how I got there. Again, it’s not that

difficult to get from $50,000 to $100,000 in just seven years. You can do it by

earning 7 percent in returns—a fair guideline for market returns—and contributing

about $150 per month to your account.

Note

the difference saving regularly makes, by contributing larger cash you may

significantly reduce the time to double your money.

it’s

entirely possible to start a humble retirement account, add $150 per month in

your 20s and 30s and still be on target to retire a millionaire. You just have

to hit your splits.

Another

thing to keep in mind about your contributions: As you get older, the amount of

cash that must be added in order to keep up the doubling effect—the 3

percent—needs to grow substantially. But you’re likely making more money, so

that’s not unrealistic. For example, between ages 37-44, you’ll grow your

retirement balance from $100,000 to $200,000 by earning 7-percent returns, for

example, and depositing at least $250 per month (based on 3 percent of

your starting balance, and assuming you’re getting 7 percent returns). Then

from ages 44-51, your balance will balloon from $200,000 to $400,000 with 7

percent returns and at least $500 in monthly deposits (3 percent of $200,000

divided by 12).

Raiz

fully automates this process, with the Roundup and Automatic Investment feature

you can hit your splits whilst living your everyday life. For more information on Raiz fees, click here.

So

yes, it’s entirely possible to start a humble retirement account, add $150 per

month in your 20s and 30s and still be on target to retire a millionaire. You

just have to hit your splits.

It

is time to start thinking about saving for retirement, just like you would if

training for a marathon. This is where Raiz can comes in. Instead

of just waking up one day and trying to sprint 42km, you need to train, and

start working on your financial fitness. Raiz fully automates this process,

with the Roundup and Automatic Investment feature you can hit your splits

whilst living your everyday life.

But

none of those facts detract from the undeniable power of regular savings, time

and compounding. A journey of a mile begins with the first

step. A journey to $1 million begins with your first $100 investment.

Important

Information

The

examples above are for display purposes only and to illustrate a point – actual

returns will be different and could be significantly less than the examples.

This

blog was written by Raiz Limited– Authorised Representative of AFSL 434776. The

Raiz product is issued in Australia by Instreet Investment Limited (ACN 128 813

016 AFSL 434776) and promoted by Raiz Limited (ACN 604 402 815). A Product

Disclosure Statement dated 27 May 2016 for this product is available on the Raiz

website and App.

A

person should read and consider the Product Disclosure Statement in deciding

whether or not to acquire and/or continue to hold interests in the product. The

risks of investing in this product are fully set out in the Product Disclosure

Statement, and include the risks that would ordinarily apply to investing.