App Guide

Table of Contents

1. Home Screen

2. Past Screen

4. Round-Ups

6. Linking and Unlinking Spending Accounts for Round-Ups

7. Linking and Changing your Funding Account

10. Positions Screen

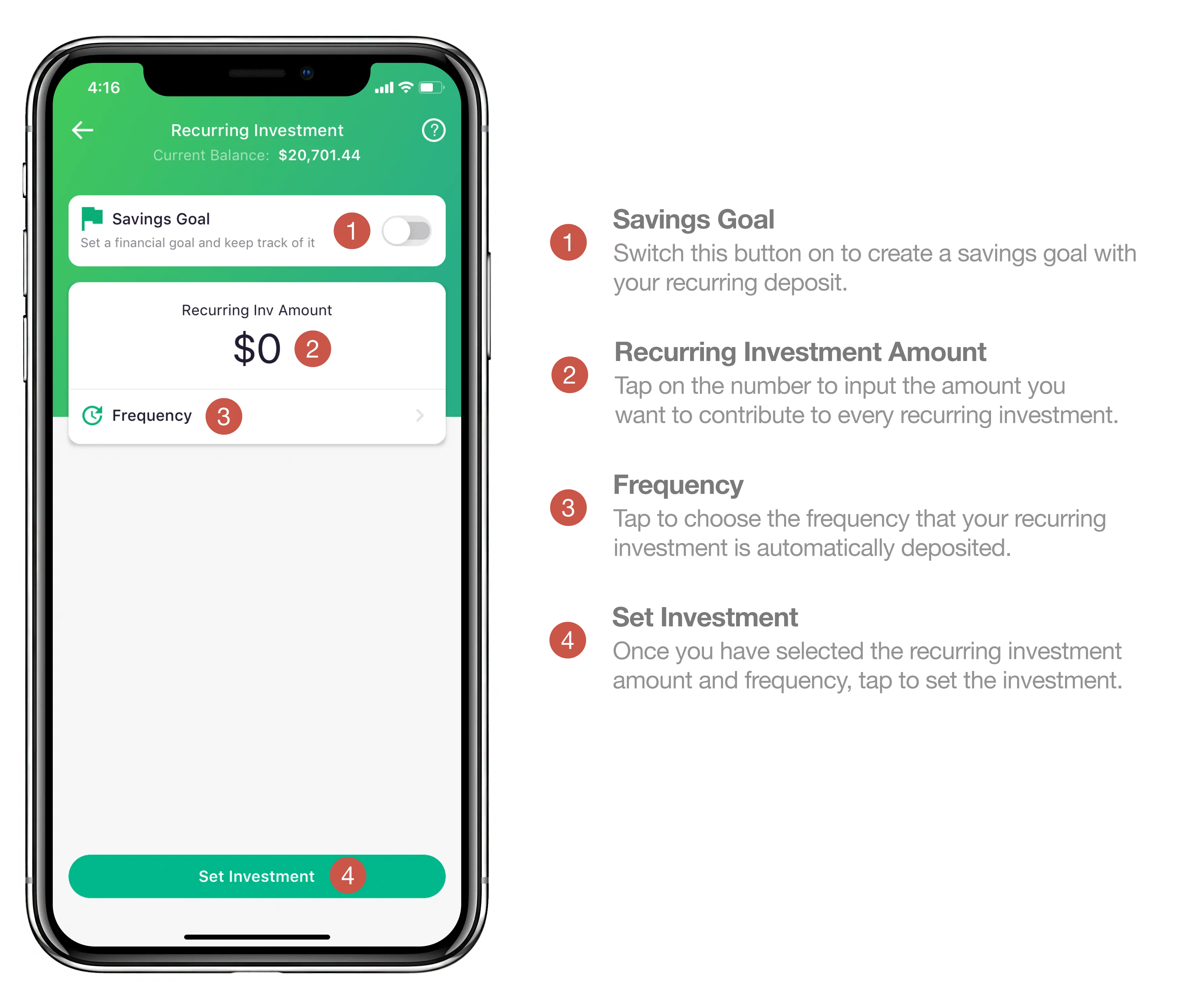

13. Set a Recurring Deposit/Savings Goal

14. Raiz Kids

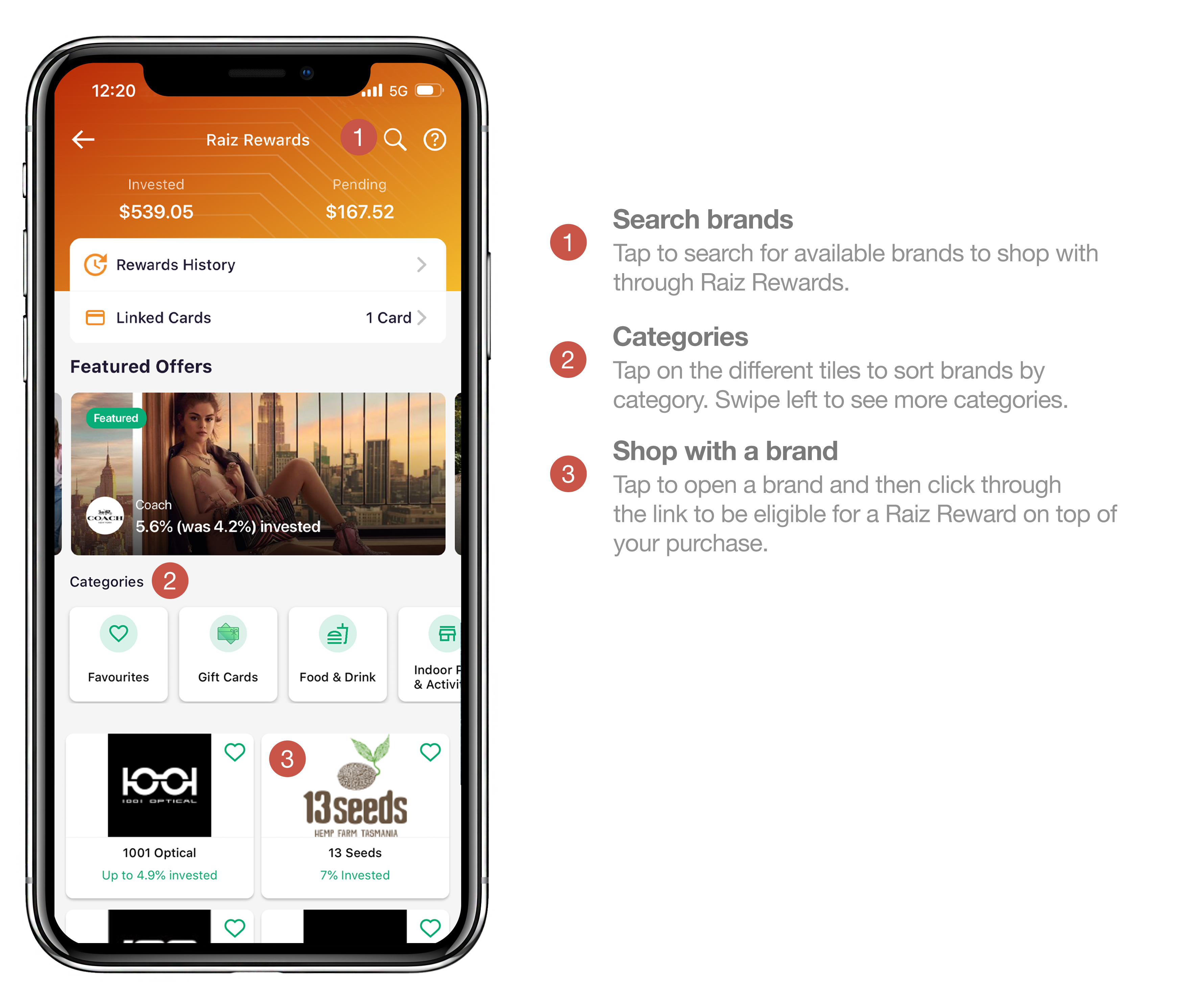

15. Raiz Rewards

16. Offsetters

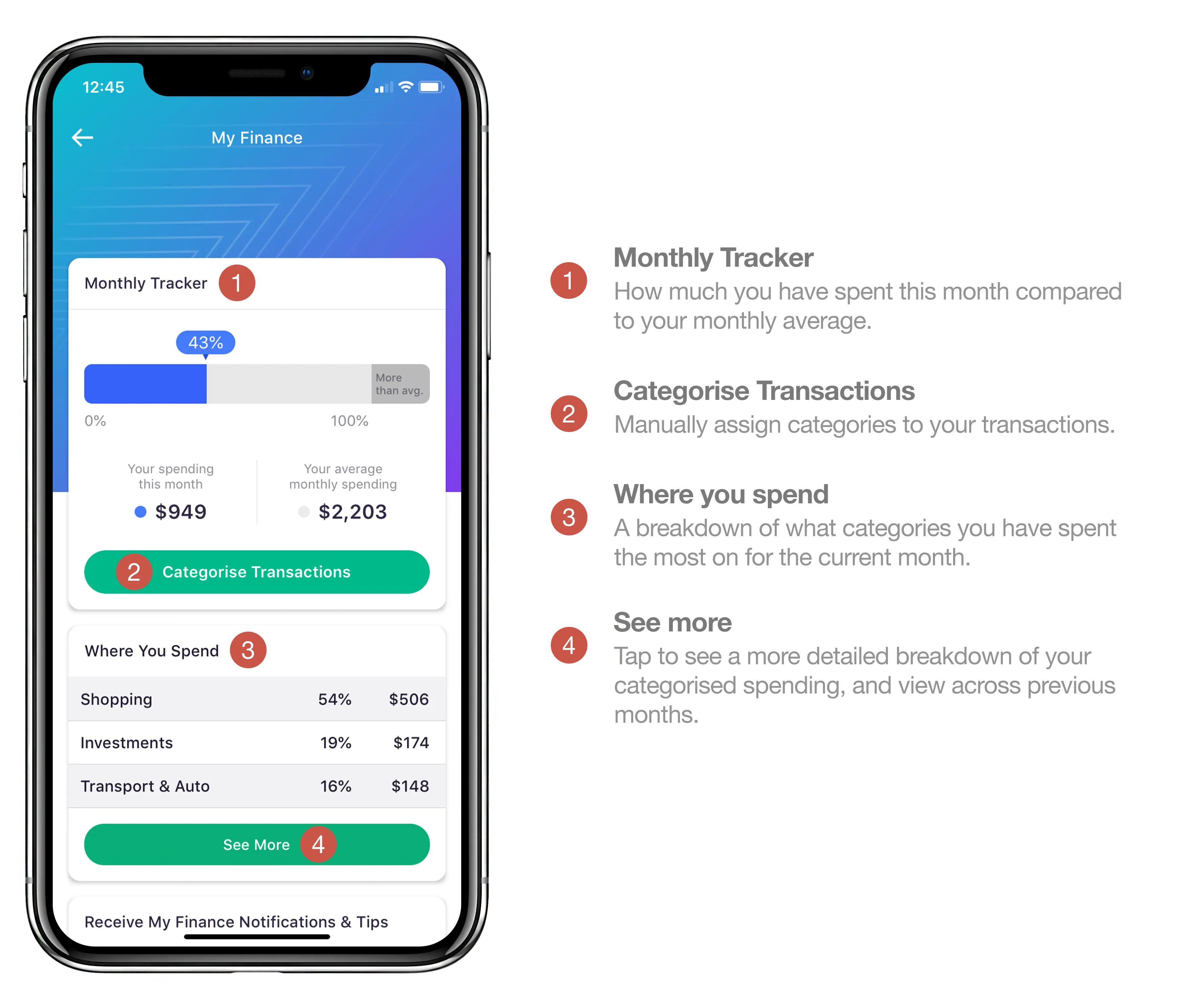

17. My Finance

Home Screen

The Home screen (also known as the Today screen) is the first screen that is displayed when you log into the app. The Home screen displays your Account Balance, any earned Raiz Rewards and your Raiz Invest Super account balance, which you can tap on to view in detail. At the top of the screen you can also navigate to the past and future screens.

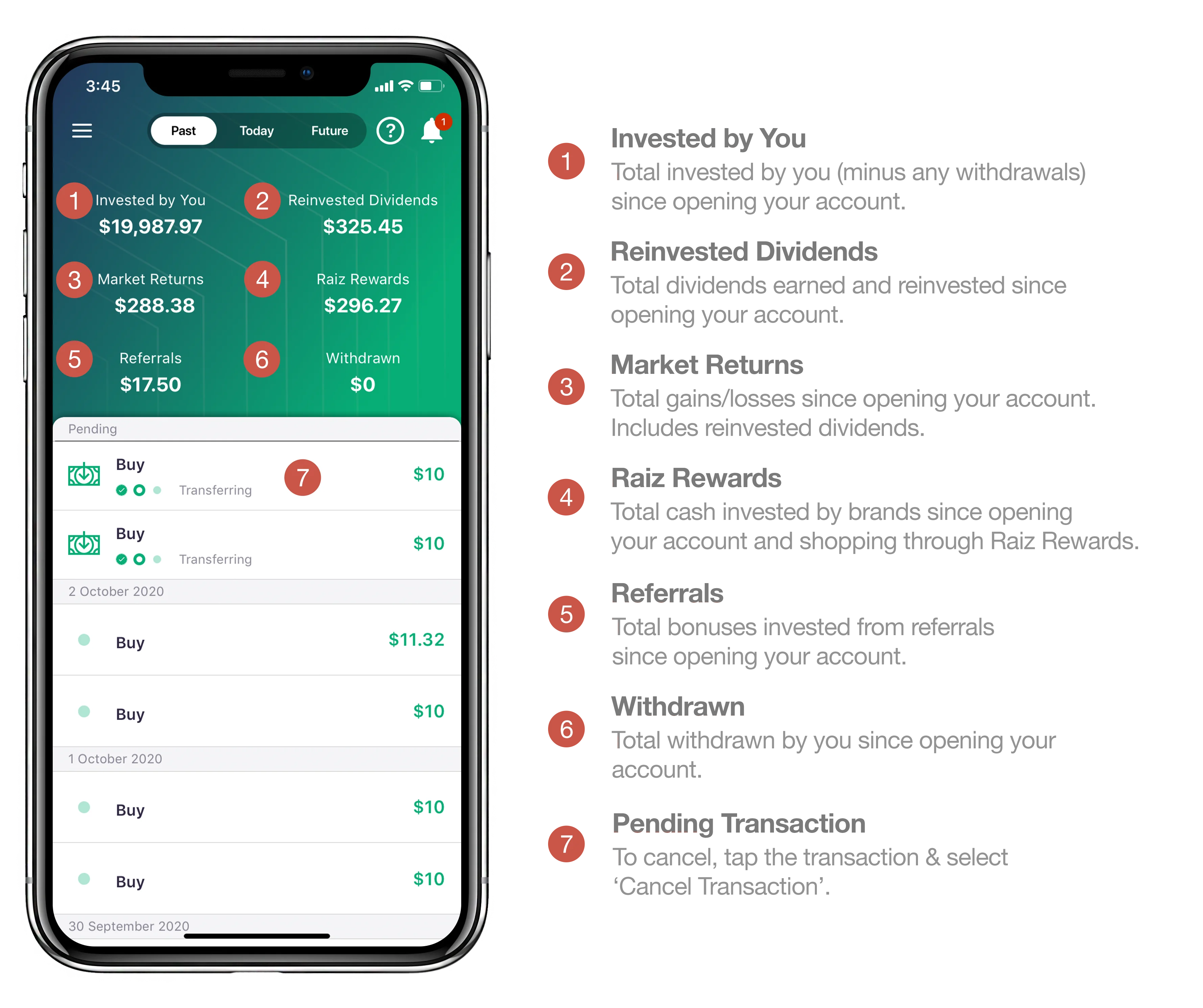

Past Screen

The Past tab is located at the top of the home page. The Past screen shows any pending and processed Buy (deposit) or Sell (withdrawal) orders as well as any reinvested Dividends.

To cancel transactions that are pending, simply tap on a pending transaction and tap “Cancel transaction”. Please note that if the “Cancel transaction” button does not appear, your investment is being processed and can no longer be cancelled.

Keep in mind that deposits to your Raiz account take 2-3 business days to process, and withdrawals take up to 5 business days to process into your bank account. Withdrawals take an extra few days because industry regulations require a 2-day settlement period after investments are sold before the money can be transferred out of an investment account. For your security you may be asked for further verification which can cause the withdrawal process to take a bit longer.

Future Screen

Our Future screen gives you a unique window into the outlook for your investment. The future screen displays a graph that shows you an estimated value projection of your investment, based on your selected portfolio, age and monthly deposit amount. Please note that the projected values shown are hypothetical in nature and should not be relied upon.

To adjust the projected monthly amount deposited, tap and drag the white dot on the graph up and down. To adjust the age, tap and drag the white dot horizontally from side to side.

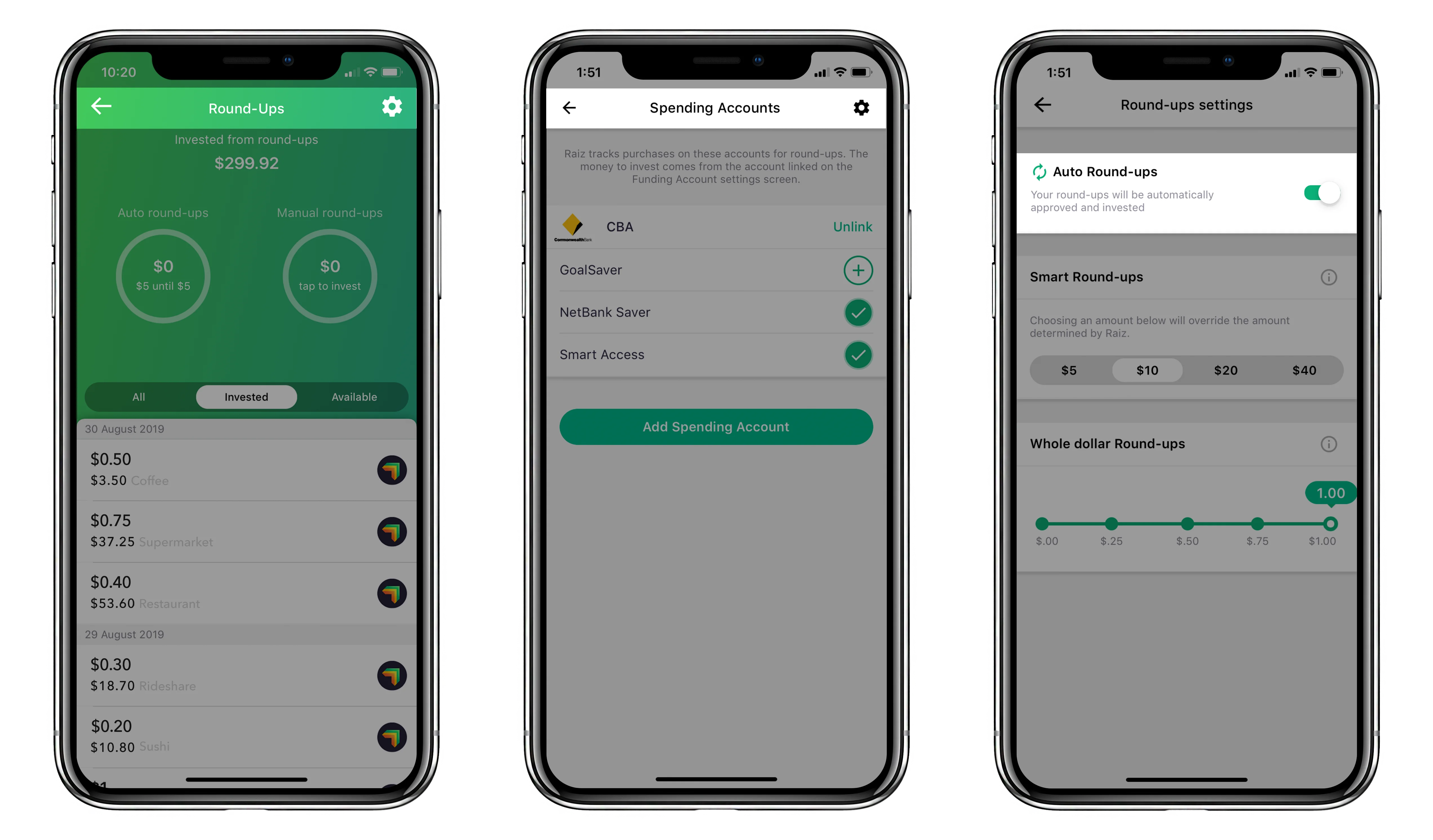

Round-Ups

When you register for a Raiz account, Automatic Round-Ups are turned on by default if you have a linked spending account. You can turn off automatic Round-Ups if you want to manually approve Round-Ups on your transactions. With Automatic Round-Ups turned on, the app will monitor your spending and automatically approve and invest your Round-Ups for you. With Automatic Round-Ups turned off, you must manually approve each Round-Up to be invested.

To enable or disable automatic Round-Ups, login to the app and go to:

Invest

Round-Ups

Round-Ups Settings

Settings Cog

Select or deselect Automatic Round-Ups.

If Automatic Round-Ups are disabled, you can choose to manually Round-Up your transactions. Simply go to the Round-Ups screen and select the + symbol next to each Round-Up transaction you would like to invest. A Raiz logo will appear next to transactions that have already been invested.

Please note that both automatic and manual Round-Ups have a minimum threshold of $5 which must be reached before they are invested. This threshold is automatically adjusted for you based on your spending habits; however, it can also be specified under the ‘Smart Round-Ups’ section of your Round-Ups settings. Once your Round-Ups reach this threshold, Raiz initiates the investment, and the transaction will be shown as pending on the History screen. Please allow 2-3 business days for investments to be processed.

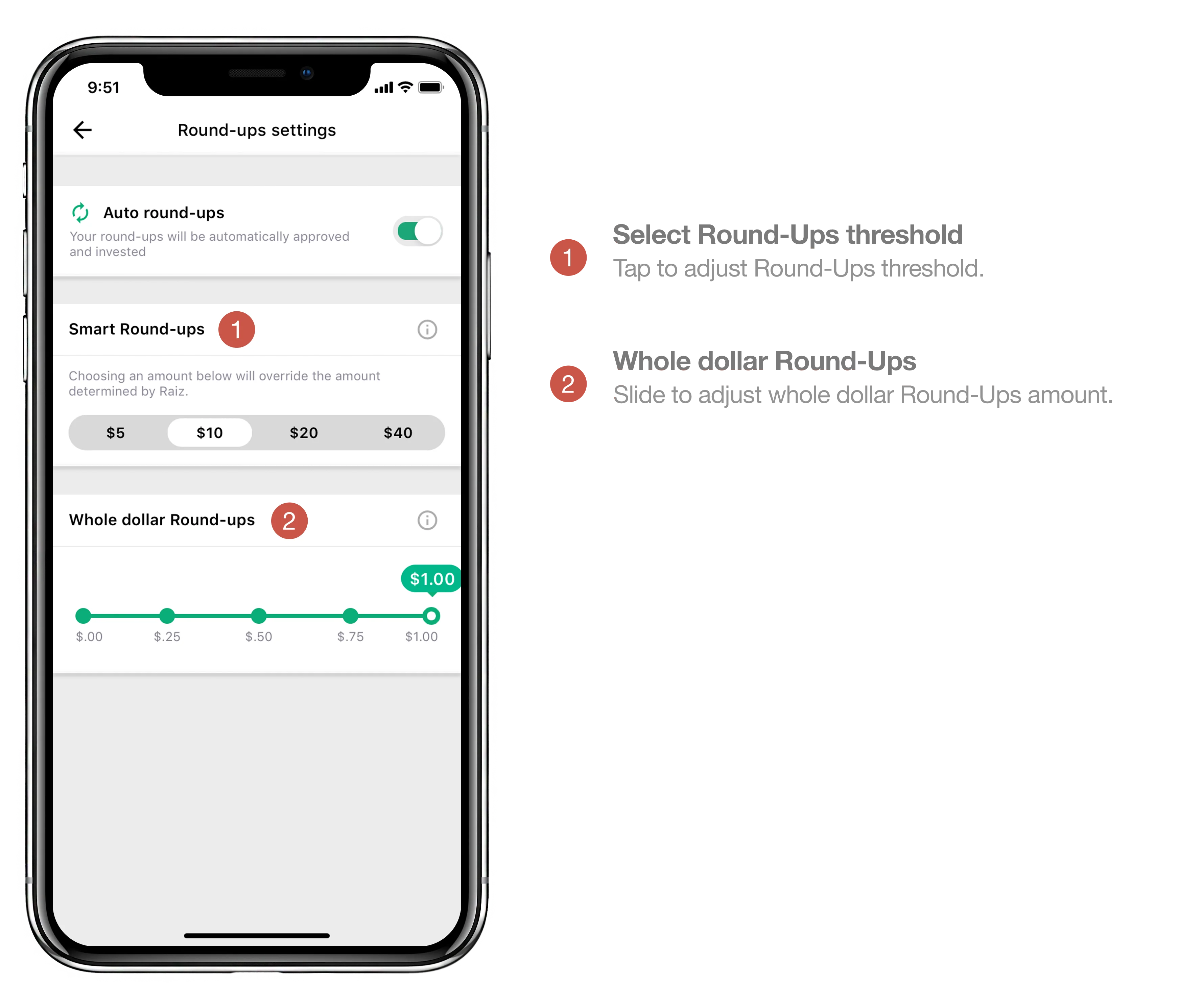

Whole Dollar Round-Ups

The app’s default behaviour is to Round-Up all transactions to the next dollar. When you make an even whole dollar transaction, such as spending $25.00 at a movie theatre, the app will Round-Up $1.00 for you (or allow you to round up $1.00 if you don’t have Automatic Round-Ups turned on). If you wish to decrease the amount that is Rounded-Up on whole dollar transactions, please follow the instructions below to configure it to any sub-dollar amount, even $0.00.

To adjust Whole Dollar Round-Ups, go to:

Invest

Round-Ups

Round-Ups Settings

Settings Cog

Drag the slider to choose the set amount that gets invested when you have a whole dollar transaction.

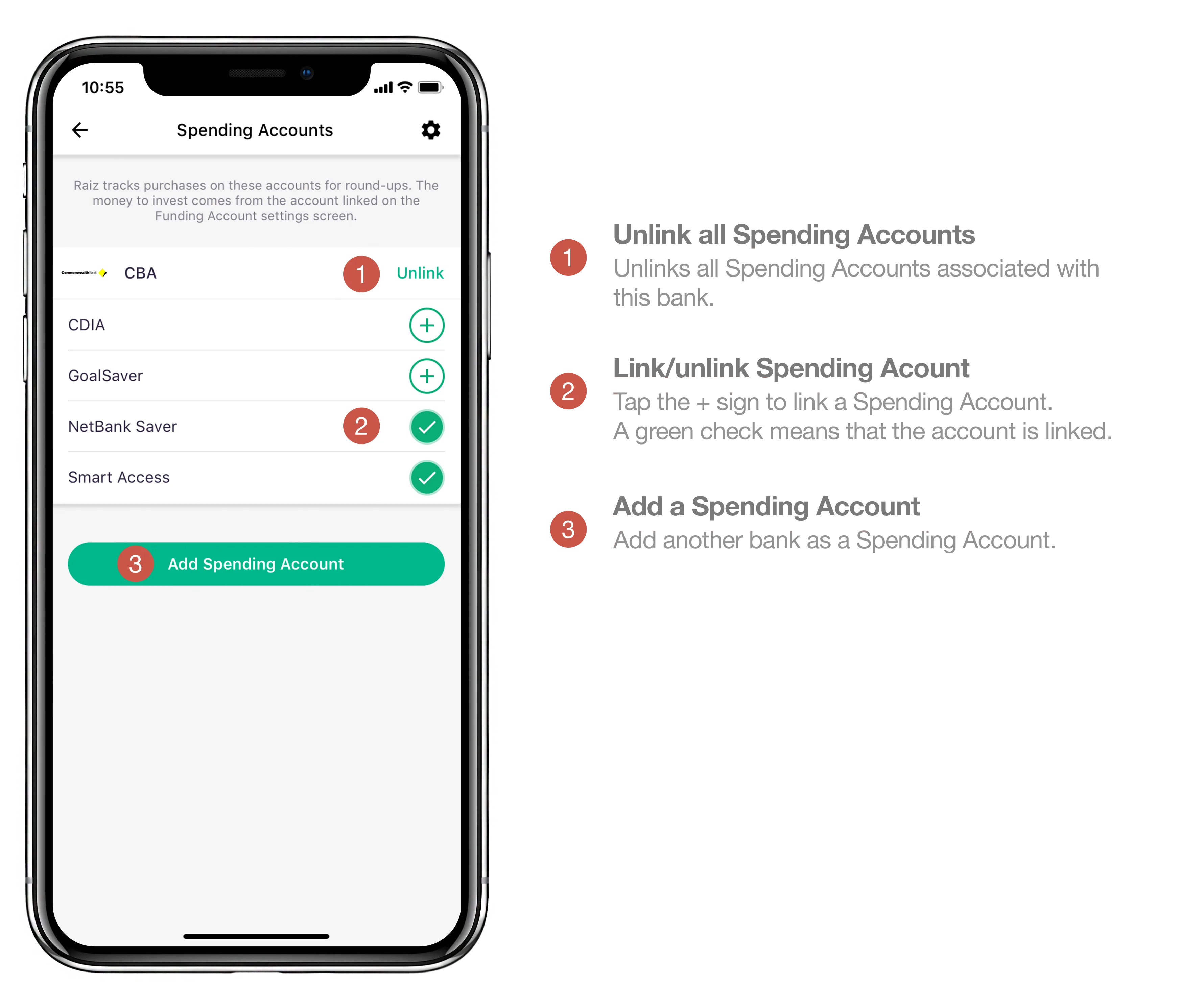

Linking and Unlinking Spending Accounts for Round-Ups

To link a spending account to Raiz you will need to be using an eligible bank that you can provide online banking login details for. Your security is our highest priority, which can read about here. To link or unlink your bank as a Spending Account to be monitored for Round-Ups, go to:

My Settings

Spending Account

To link a new Spending Account, tap ‘Add Spending Account’ and follow the prompts on the following screens. For further instructions, see our Registration Guide.

To select additional Spending Accounts to monitor for Round-Ups (effectively turning them on for Round-Ups), tap the plus signs next to the sub-accounts that you wish to use for Round-Ups. These will usually be the bank accounts that you often use for purchases. Some accounts with infrequent activity may not show any Round-Ups once they are activated. Once you have selected a bank account for Round-Ups, its plus sign will turn into a green circle with a check mark in it.

To deselect Spending Accounts so that they will not be used for Round-Ups, simply tap their green circles with check marks, which will turn back into plus signs.

To unlink an entire Bank Account and therefore all its Spending Accounts, tap Unlink next to the bank or credit provider name.

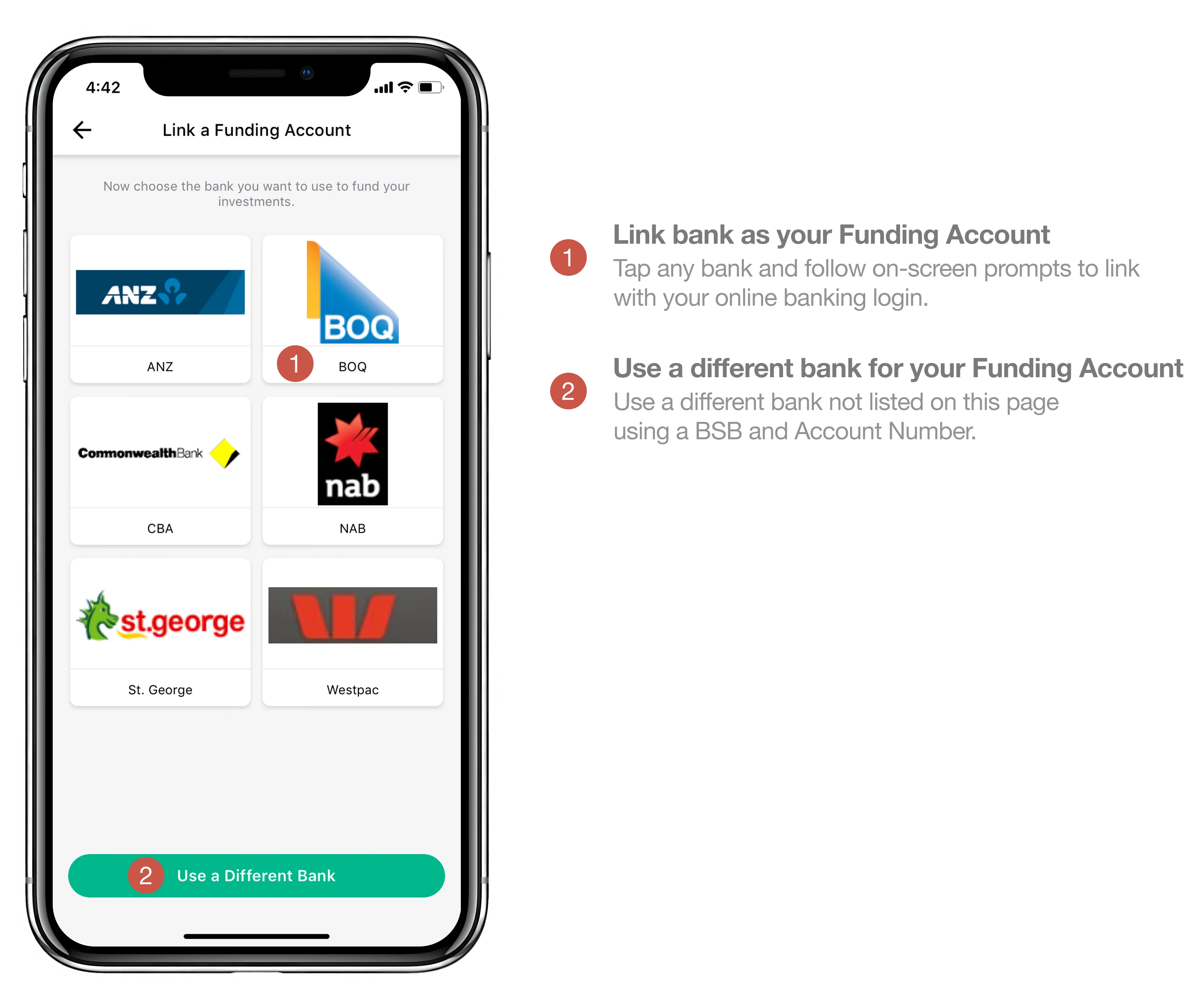

Linking and Changing your Funding Account

To link or unlink a funding account, go to:

My Settings

Funding Account

To link a Funding Account using your online banking details, tap on your bank and follow the on-screen prompts.

If you would prefer to use a BSB and account number, or your bank is not listed, tap on ‘Use a Different Bank’ and enter your account details.

To change your funding account tap ‘change’ on the funding account screen and go through the same steps as above. Please note that you may be required go through some additional verification steps to change your funding account.

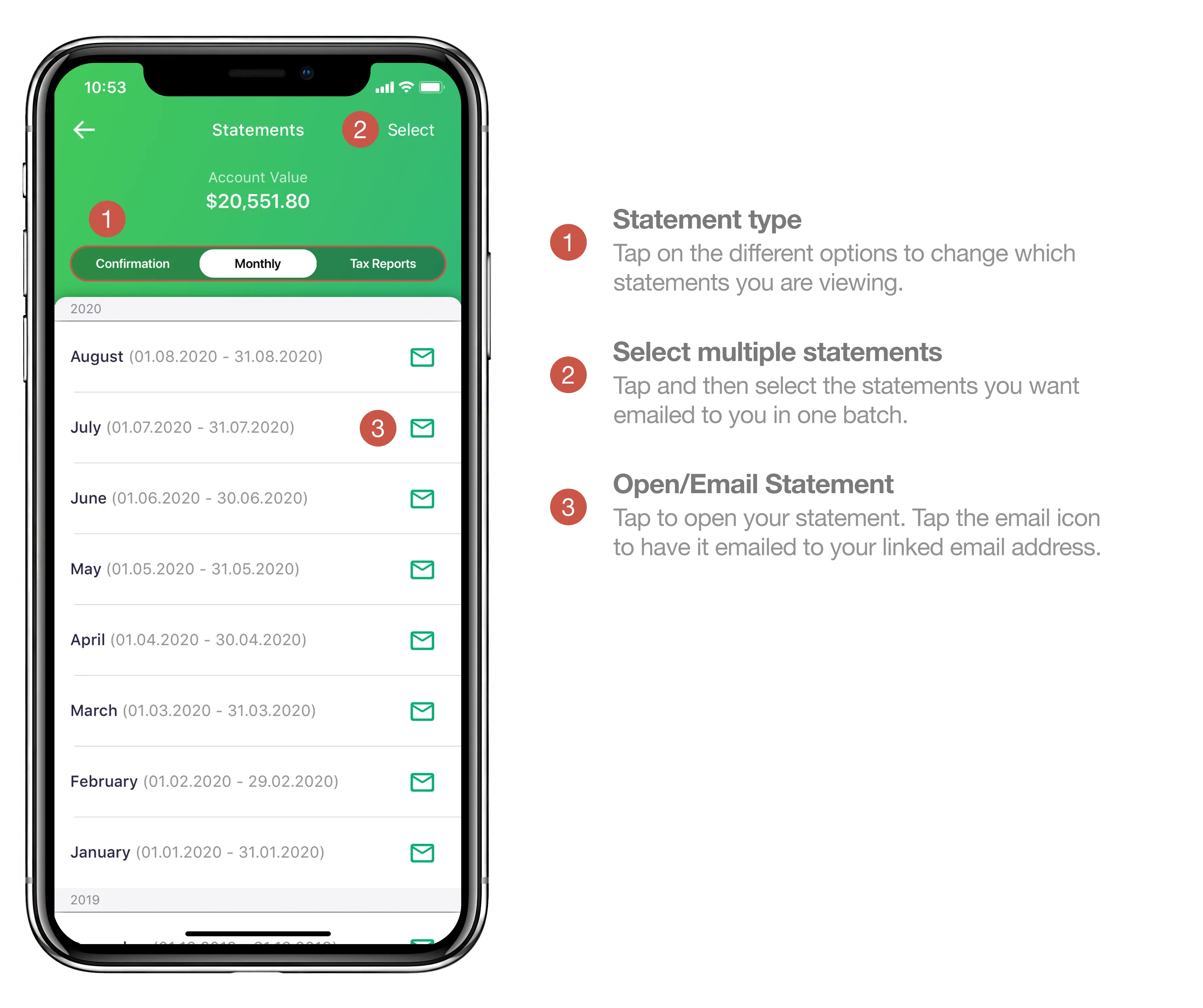

Access your Statements

Raiz automatically provides you with monthly account statements, annual tax reports, and daily trade confirmations. To access these, go to:

My Settings

Support

View Statements

From the Statements screen, you can navigate between your different statements by tapping on the bar below your account value.

You can view your statements in a browser by tapping on them, or have them emailed to you by tapping the mail icon to the right of each statement.

Tap on ‘Select’ in the top right of the screen to select and email multiple statements at the same time. Just tap the grey circles next to the statements you wish to select and then tap ‘Send to email’.

You can request to have a .csv File of your statements sent to you by contacting support@raizinvest.com.au

Performance Screen

The performance screen shows you how your Raiz balance has changed over time. By tapping and dragging your finger across the graph you can see information about your balance for different dates.

At the bottom of the screen you can change the time period to view your balance, starting at 1 day on the left, and then moving to 1 month, 3 months, 6 months, 1 year and All Time.

The big number at the top is your account value, and underneath that shows your market returns for the selected period. You can read about how the percentage is calculated here.

The graph itself displays two lines. The white line is your total balance, including market returns. The green line represents ‘invested by you’ which is all of your deposits minus any withdrawals. The difference between these two lines represents any market gains/losses at that point in time.

The table at the bottom of the graph shows you the cumulative amount for a few different values that contribute to your Raiz account balance. The date for these values changes as you drag your finger along the graph. The ‘Rewards’ figure includes Raiz Rewards and Referral bonuses.

You can switch to your ‘Positions’ screen by swiping left at the bottom of the screen.

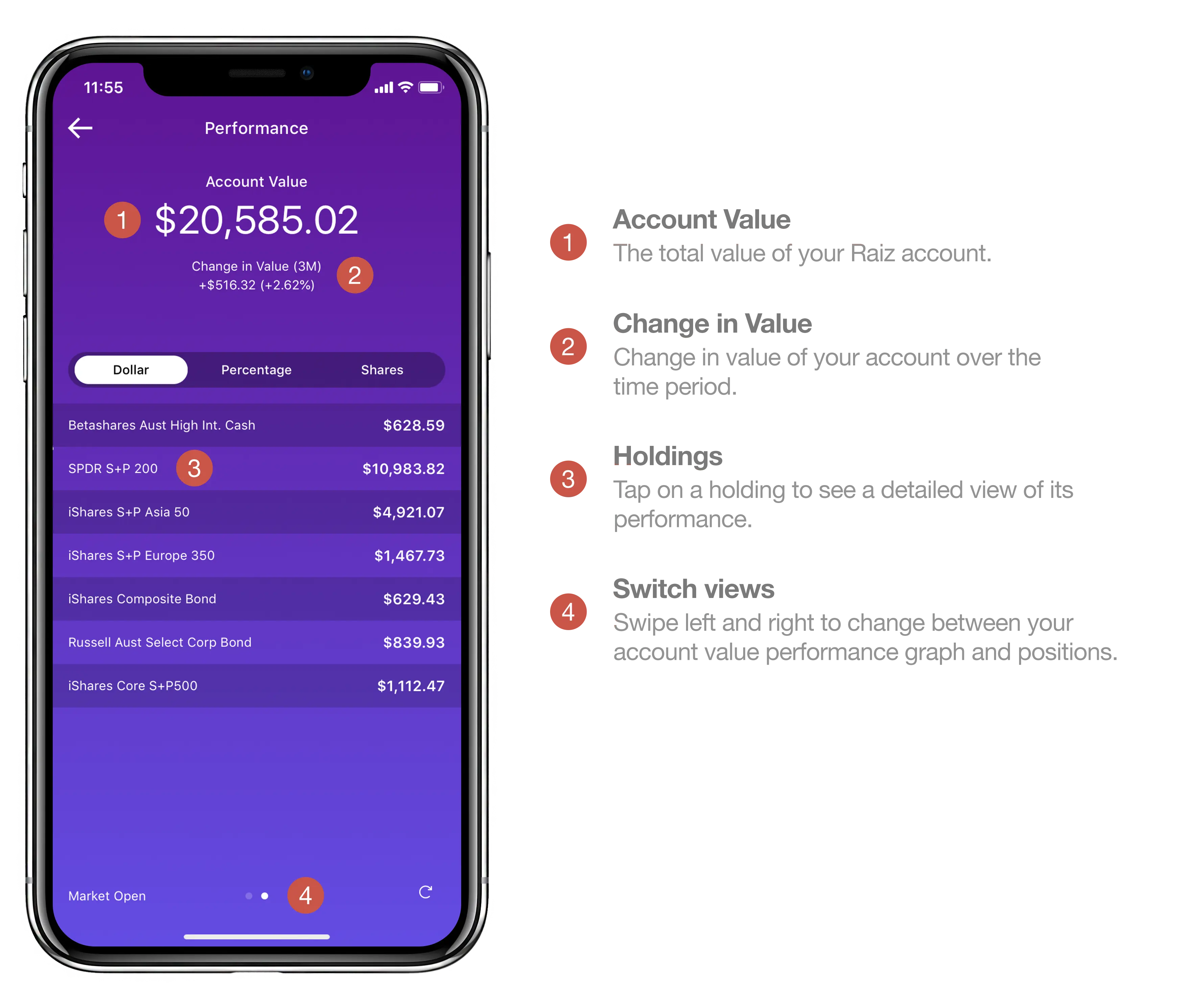

Positions Screen

To navigate to this screen, go to your performance screen and then swipe left.

The big number at the top of this screen is your account value. This is the same value displayed on your home screen. The Change in Value figure beneath displays the total change in value of your portfolio over the selected time period.

Using the navigation bar under your account value, you can choose between the dollar values, percentages, and number of units you have for each holding in your Raiz portfolio.

Under the navigation bar, you can tap on a fund to access its information and historical performance.

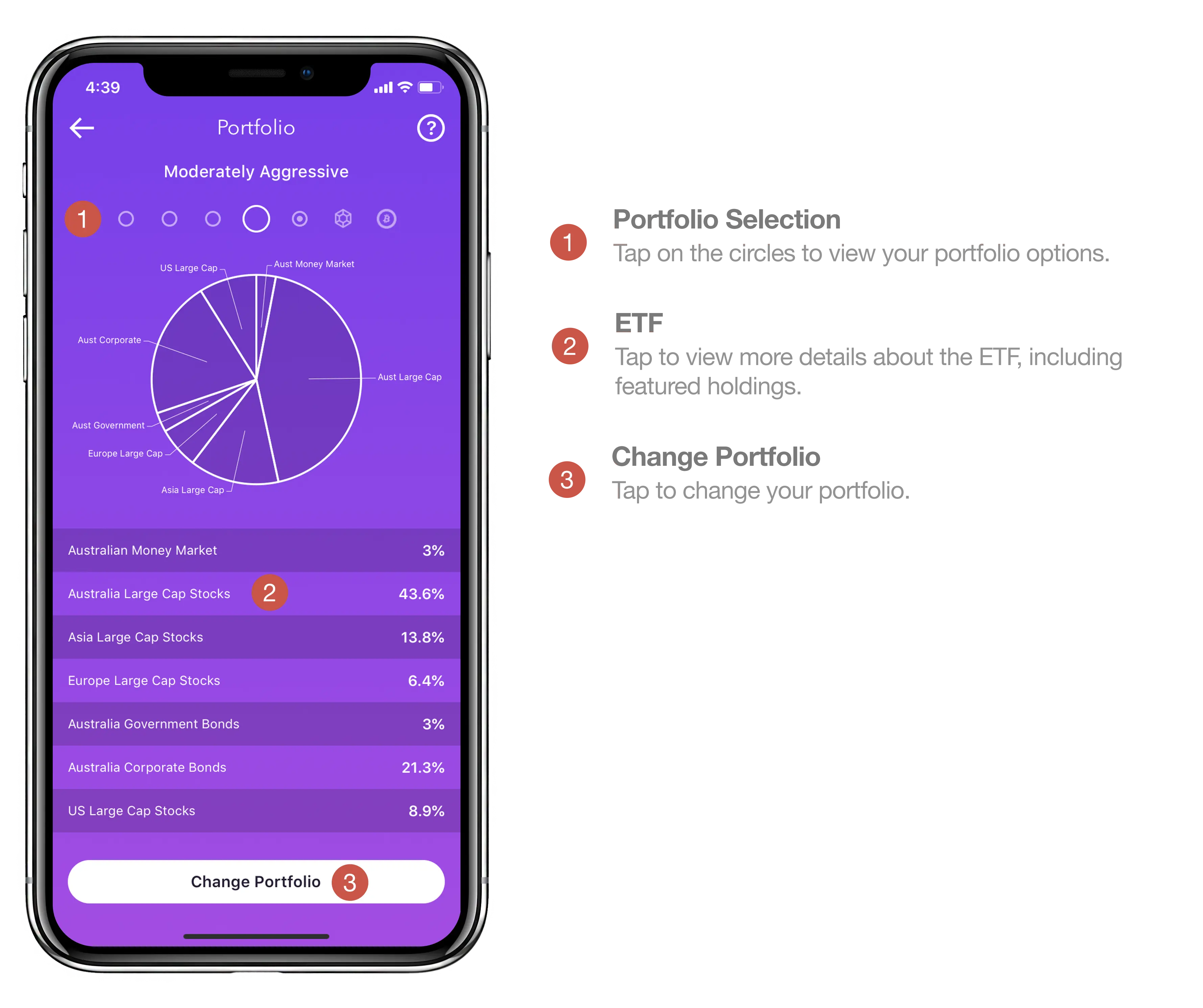

Portfolios Screen

Raiz offers 7 different portfolios with set asset allocations, each comprised of varying allocations of ETFs and Bitcoin based on different degrees of risk. You can change your portfolio at any time. You might consider changing your portfolio if your investment goals, time horizon, preferred level of risk, or other factors change.

Change your portfolio at any time by accessing the app and selecting:

Invest

Portfolio

Tap one of the 7 different selectable circles, each representing a different portfolio.

Once you have decided on a portfolio, confirm this change by selecting Change Portfolio.

The portfolio that you select determines how we invest your money. The funds that you deposit into your Raiz account are invested according to the target allocations of your selected portfolio. If your account moves too far away from the target asset allocation, or when you deposit or withdraw money, Raiz will automatically rebalance your positions by selling and/or purchasing shares or fractional shares of the ETFs (or bitcoin), to bring them back in line with your target allocation. A rebalancing will also occur when you change your portfolio.

Deposit and Withdraw

It’s easy to deposit and withdraw money with Raiz. From the home screen tap on invest, where you’ll then see two buttons at the top of the screen, one to deposit and one to withdraw. You can withdraw through the app at any time without penalty, however the withdrawal may not be actioned until the next business day by Raiz. The minimum investment is $5. Deposits take 2-3 business days to be invested into your Raiz account, whilst withdrawals can take up to 5 business days for the funds to reach your nominated funding account. You can view the status of and cancel deposits and withdrawals in the ‘Past’ tab.

Set a Recurring Deposit/Savings Goal

Recurring Deposits and Savings Goals make it easy to regularly add money to your Raiz account, helping you stay disciplined with your investing and reach your investing goals.

If you did not set up a Recurring Deposit/Savings Goal when you signed up to Raiz, you can set one up through the ‘Invest’ section of the app.

To set up a recurring investment just select the amount of money you wish to invest regularly and then choose a time period that suits you – whether that’s on a daily, weekly, fortnightly or monthly basis.

Along with your recurring investment, you can also choose to create an accompanying savings goal, allowing you to pick something to save for and track your progress in reaching a target balance. To create a savings goal, tap on the savings goal switch at the top of the screen when you are setting or changing a recurring investment.

Raiz Kids

Raiz Kids is a simple way for parents to save and invest for their children and help them start adulthood with a solid financial basis. Grandparents can also save for Grand Children.

Part of the Raiz app, Raiz Kids enables you to set up to eight Raiz sub-accounts for anyone under the age of 18. An exciting feature of the Raiz Kids platform is the option for your Kids to have their own direct access to their investment portfolio! It’s an awesome way to teach your kids about taking care of their money and developing positive savings and investing habits.

With the new and improved Raiz Kids platform, you’ll able to create different portfolios for each child, create recurring investments and modify and monitor their ability to make changes to their Raiz Invest Kids Accounts.

How to set up a Raiz Kids Account:

Head to “Invest” on the Home Page of the Raiz App or website and scroll down to “Automatic Savings for your Child”.

Enter the personal information for your child:

PERSONAL INFO: Enter their name and Date of Birth.

LUMP-SUM INVESTMENT: Select an initial one-off investment into their new account.

PARENTAL CONTROLS: Choose what level of control your child can over the investments.

RECURRING INVESTMENTS: Create a recurring Investment, whether it’s Daily, Weekly, Fortnightly or Monthly.

PORTFOLIO SELECTION: Select from one our 7 expertly designed portfolios, or make one up of your own!

RAIZ KIDS CONTROLS: Select further access controls relating to the recurring investments and portfolio.

NOTIFICATIONS Determine what notifications you’d like to receive when your Raiz Kid makes any changes to their account.

Any investments made into the Raiz Kids Account, whether via a lump sum investment, recurring investment or automatic round-up, will be debited from your funding account. You can review and update the funding account by heading to My Settings > Funding Account > Change.

Raiz Rewards

Raiz Rewards is our cashback, or rather “cash-forward”, loyalty program. Each time you shop with your favourite brands through Raiz Rewards, you will earn a cash reward direct from the brand invested back into your Raiz or Raiz Invest Super account.

To shop online, from within your Raiz App, tap on Rewards, select the brand you would like to purchase from, tap the ‘Shop Now’ link and make your purchase immediately. By clicking on the link, the brands can automatically track your purchase and invest the reward into your Raiz or Raiz Invest Super account.

To shop in-store, you need to activate the in-store offer within Raiz Rewards before you make a purchase at one of the brand’s Australian stores. Each in-store brand has a start and end date for their offer, you only need to activate the offer once during those dates and any purchases made on your linked spending card will be eligible.

Raiz Rewards are typically reinvested back into your Raiz account within 30 days from the date of purchase (in-store can take up to 90 days). Each partner link has their own terms and conditions (T&Cs). Please make sure you read the T&Cs for the partner before using Raiz Rewards.

Offsetters

Offsetters is our environmentally conscious community which helps fund projects to offset your carbon footprint. An Offsetters subscription is $3.70 a month. To become a member of the Raiz Offsetters program you can scroll down on the homepage and tap on ‘Learn More’ in the Offsetters tile. From here, simply tap on ‘Join Offsetters Now’.

You can choose to unsubscribe from Offsetters by going to:

Side Menu

My Settings

Support

Offsetters Unsubscribe

Tapping the ‘Yes’ button

If you wish to become an Offsetter again you can follow the same steps to resubscribe.

My Finance

The My Finance tab is a useful tool within Raiz to help track and categorise your spending, which can assist in creating and sticking to your budget. My Finance will only analyse transactions made from your linked spending accounts. To view your My Finance page, tap on the menu tab located on the top left of your Home page and select the My Finance option. Within the My Finance page you can choose to categorise transactions, see where you spend, and forecast income and spending.

To categorise your uncategorised transactions tap on the ‘Categorise Transactions’ button. You can then individually assign a category to each transaction by tapping on each.

You can track where you spend by tapping on the ‘See More’ option in the Where You Spend Category. In the Where You Spend page you will be able to see a detailed breakdown of your expenses each month including the dollar and percentage values of each category. You can also compare month-to-month spending by using the interactive graph on the top of the page.

The app allows you to forecast income and spending to help with cash flow in the next 30 days. You can find this by scrolling down on the My Finance page and tapping on the ‘Forecast Income and Spending’ button. The app takes an estimate of your income and expenses to forecast any potential spare cash.

Raiz Invest Super

You can access your Raiz Invest Super account by clicking on the Super option on the home screen. Once on the Raiz Invest Super screen you will be presented with many options including making a Lump sum investment, your personal Super information, Rollover Super from other superfunds, your choice of Portfolio, turning on/off Raiz Rewards contribution and setting up a Recurring investment into your Raiz Invest Super account.

You can view the history of your Raiz Invest Super account by scrolling down and selecting the ‘History Details’ button. Like your regular Raiz account, the Raiz Invest Super ‘History details’ displays your total Employer Contributions, your own personal contributions, reinvested dividends, market returns and the total Rollover amount over the history of your Raiz Invest Super account.

To view the performance of your Raiz Invest Super account you can scroll further down on the Raiz Invest Super screen and tap on ‘performance details’. From here you will be able to adjust the performance over time from 1D, 1M, 3M, 6M, 1Y and All time. It has the same functionality as your regular Raiz account performance screen.

If we have missed anything you think should be explained further, or need any clarification on this guide, please do not hesitate to contact us on 1300 754 748 or email us: support@raizinvest.com.au