Pokemon Go sky rocketing Nintendo share prices

Unless

you have been living under a rock, it would have been impossible to not notice

that Pokemon Go has taken Australia by storm.

Launched

last week, Pokemon Go is a mobile game which has reinvented

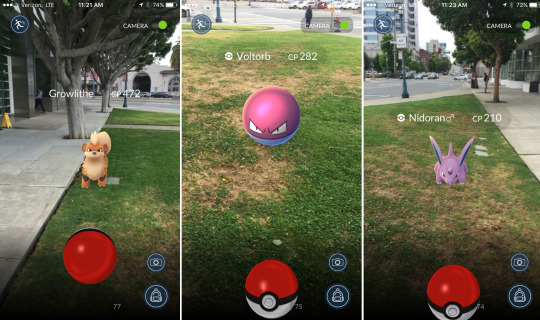

the popular 90’s cult franchise Pokemon. The game uses GPS to track players and

through their smartphone cameras, incorporates the game’s monsters into the

player’s surroundings.

The

game has been an instant hit, with the app currently topping several charts on

Apple’s App Store. Nintendo shares are up 60% in the past three days

since Pokemon Go was launched on the 7th of July – illustrating the power

of pop culture!

Nintendo

has enjoyed a whopping AUD$12bn increase in market value. It should give a new

lease of life to the conservative Kyoto-based firm, which had long steered

clear of smartphone gaming.

The

app is free to download and is estimated to have been downloaded 7.5bn times in

the US alone. The lucrative value of the app is seen in its in-app purchases,

which occurs when a player is tempted to buy more useful items within the game.

Excuse

the pun, but Pokemon Go is literally ‘changing the game’ when

it comes to mobile apps. We can’t wait to see how more apps like this push

boundaries and sail into uncharted territory.

Important Information

The information on this website is general advice only. This means it does not consider any person’s investment objectives, financial situation or investment needs. If you are an investor, you should consult your licensed adviser before acting on any information contained in this article to fully understand the benefits and risk associated with the Raiz product.

The information in this website is confidential. It must not be reproduced, distributed or disclosed to any other person. The information is based on assumptions or market conditions which change without notice. This will impact the accuracy of the information.

Under no circumstances is the information to be used by, or presented to, a person for the purposes of deciding about investing in Raiz.

Past return performance of the Raiz product should not be relied on for deciding to invest in Raiz and is not a good predictor of future performance.