5 Ways to Save More with Raiz

Do you like to save? Here are 5 ways to save more by making the most out of Raiz!

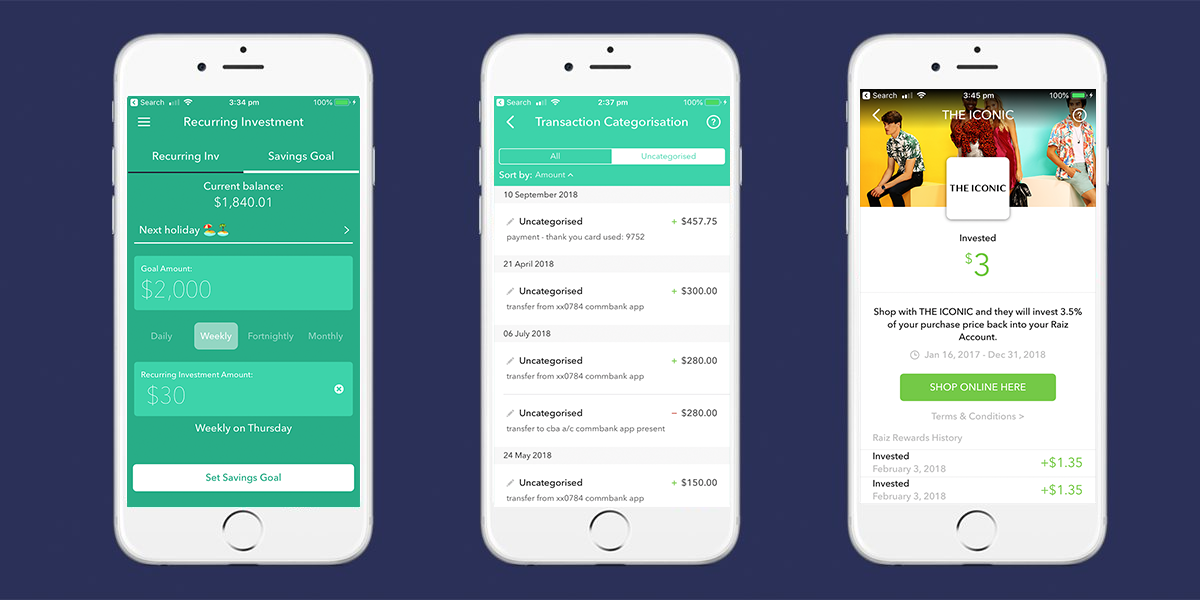

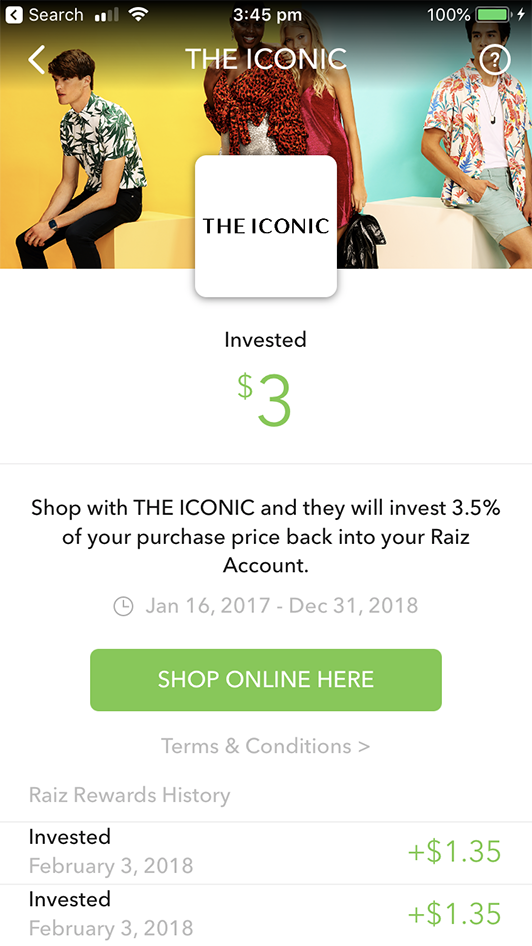

Automate your Savings Goal

By automating and naming your savings goal, this will help reaching your goal easier. With our Savings Goal feature, you can set a recurring investment in-line with your pay day, as Raiz allows you to customise investing daily, weekly, fortnightly or monthly. You can customise the goal name to keep you focused on what you are trying to achieve. You are also less likely to miss or notice the money when investing in small amounts regularly and stops you from thinking “I will save on my next pay” (on every pay check!). For more information on Raiz fees, click here.

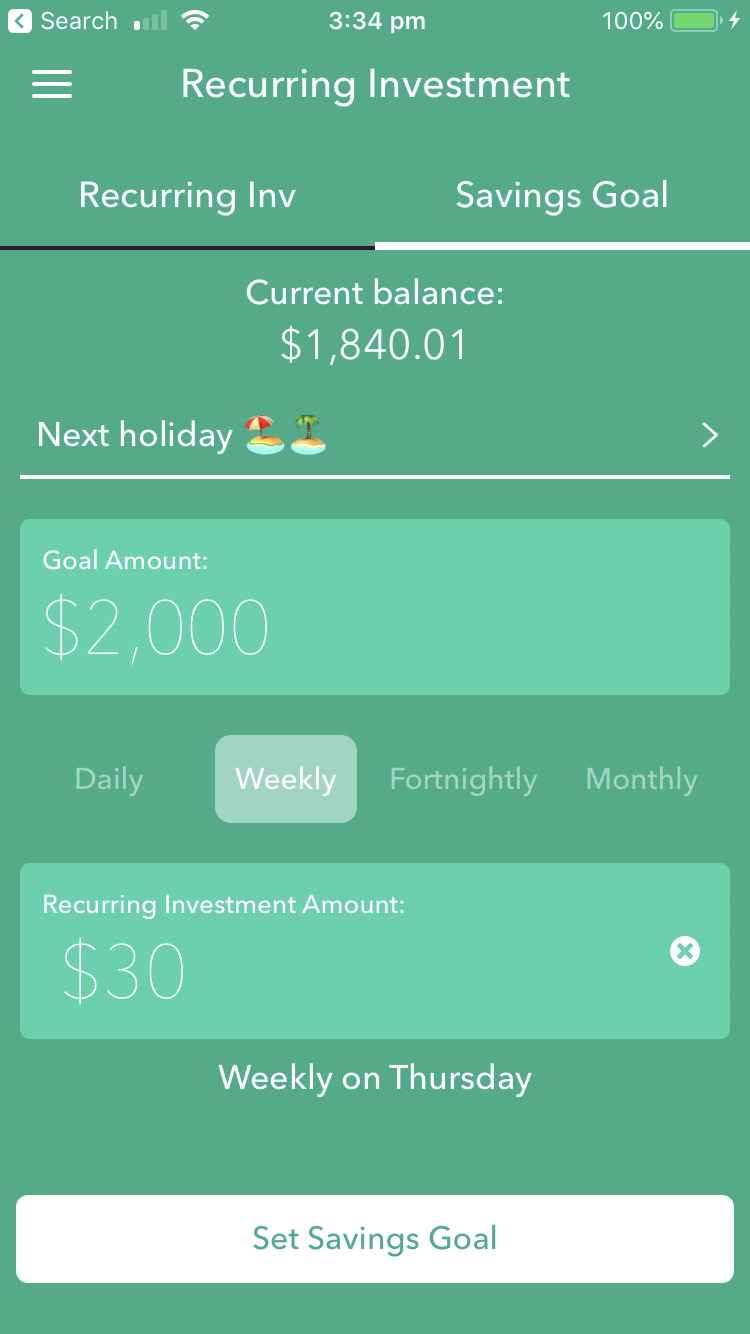

Check out ‘Uncategorised’ tab in My Finance

MyFinance is a free to use feature within the Raiz app. It provides you personalised insights and notifications on how you are spending. Spending is the other side of the equation and keeping a handle on this can help you meet your savings goals.

MyFinance also projects your future free cash based on your past spending and income, which may also help you determine if you are spending above your means or if you can save more. To make the most out of it on ways to save more, link up all your spending accounts and check out the ‘Uncategorised’ tab within ‘Categorise Transactions’ to categorise any that MyFinance was unable to. MyFinance will then learn to give you better insights, powered by machine learning technology.

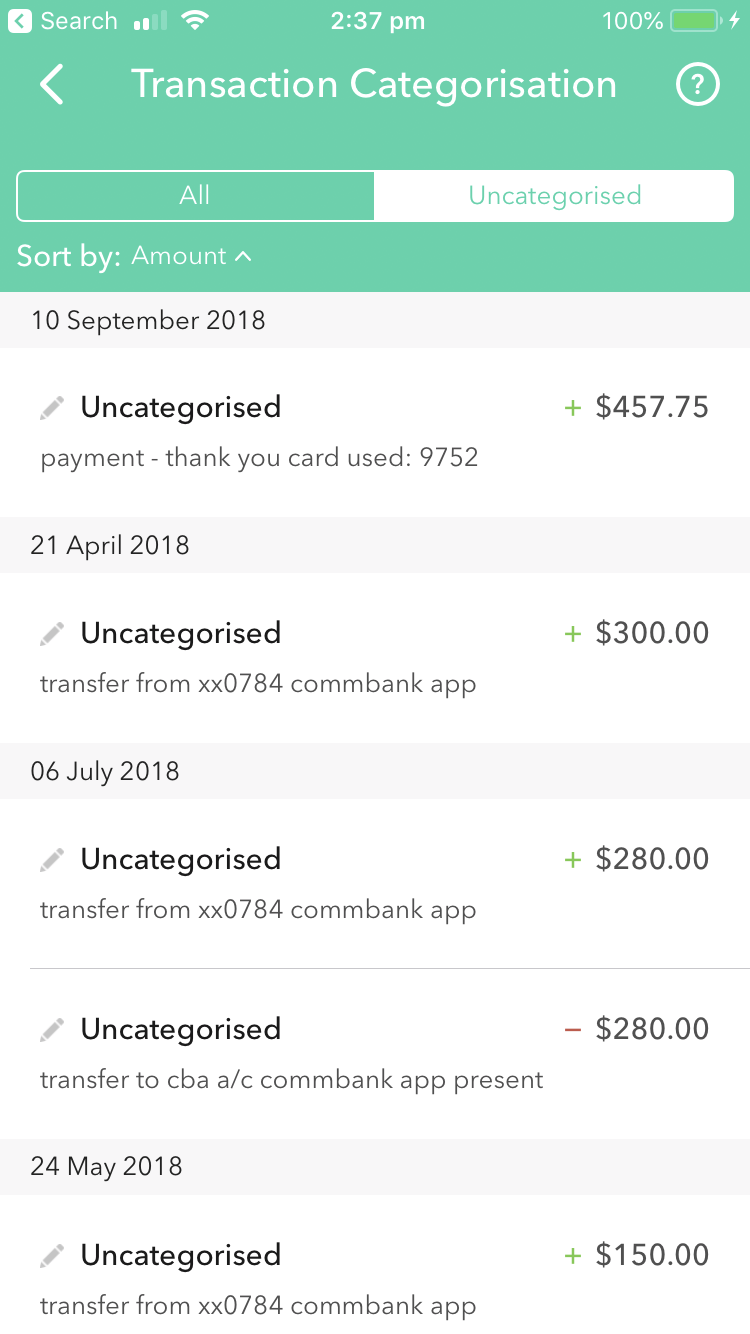

Do your normal shopping through Raiz Rewards

Better than loyalty points! Racking up points which you can redeem later (for half a toaster…) have been the traditional model for rewards programs. With Raiz Rewards, by just clicking through our links, you can earn a cash reward on eligible purchases, invested back into your Raiz account. Just like the Raiz philosophy, all these small rewards can add up, especially with over 100 brands partners to shop from. Already do your clothing or grocery shopping online? Take advantage of saving more simply by doing the same shopping through the Raiz platform and receiving a cash reward every time. Read more about ways to save with Raiz Rewards on our blog – ‘Raiz Rewards: Cash-forward is the new cashback‘

Get to know your finances instantly with Ashlee, the Raiz Chatbot

The problem with managing your finances in the past was having to manually do it yourself, usually through a tedious spreadsheet. We’ve changed this by integrating our chatbot, Ashlee, with Facebook Messenger. Much like a personal fitness coach, Ashlee makes getting to know your finance easy and simple. She can respond in real-time on questions around your spending habits e.g. “How much did I spend on shopping last week?” or “how about last month?” as well as answer questions on future savings e.g. “Can I afford to buy a new phone?” or “how long will it take me to save $2,000?”. For more questions and ways to save more, check out our blog – ‘Ask Ashlee – Raiz Intelligent Chatbot Questions‘

To use, just go into your Facebook Messenger app and search for ‘Raiz Chatbot‘. Please note, you will need a Facebook Messenger account to access the Chatbot. The more up to date your MyFinance is with categorised spends and linked accounts, the more accurate the responses from Ashlee will be.

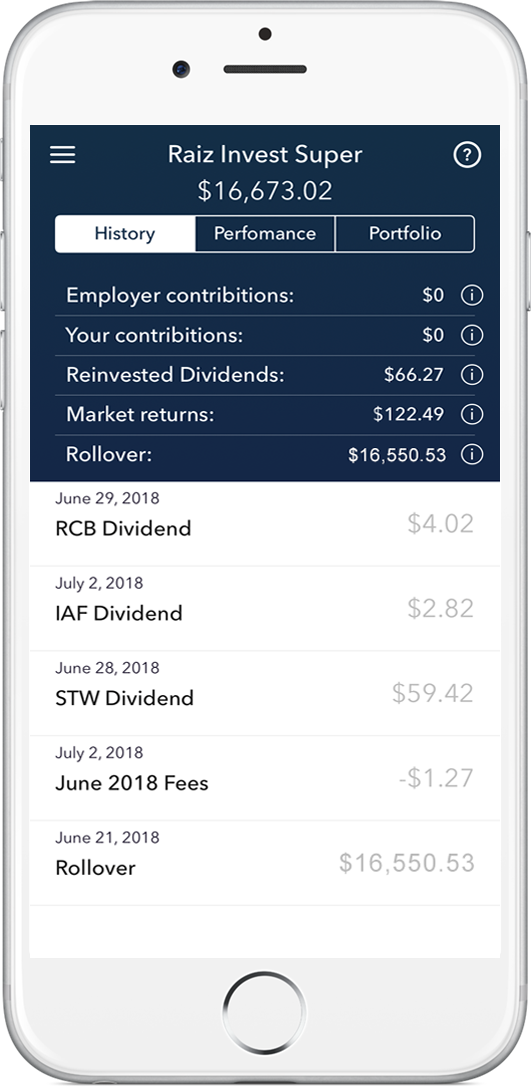

Personal Contributions to Raiz Invest Super

The more you save for your future now, the higher the potential income can be when the future arrives. New laws passed in July 2017 means all employees are now eligible to claim personal tax deductions on contributions up to a cap. Prior to this, it was limited and required arranging a salary sacrifice with your employer. This means now your savings in Raiz Invest Super may be tax deductible* through personal contributions!

You can also open a Raiz Invest Super account and see all your other superannuation funds or consolidate any other existing Super funds you may have into Raiz Invest Super. By doing this, it may save you more from removing extra fees and insurance premiums. With Raiz, see all your investments in one place on your mobile phone.

Don’t have the Raiz App?

Download it for free in the App store or the Webapp below:

Important Information

The information on this website is general advice only. This means it does not take into account any person’s particular investment objectives, financial situation or investment needs. If you are an investor, you should consult your licensed adviser before acting on any information contained in this article to fully understand the benefits and risk associated with the product.

A Product Disclosure Statement for Raiz Invest and/or Raiz Invest Super are available on the Raiz Invest website and App. A person must read and consider the Product Disclosure Statement in deciding whether, or not, to acquire and continue to hold interests in the product. The risks of investing in this product are fully set out in the Product Disclosure Statement and include the risks that would ordinarily apply to investing.

The information may be based on assumptions or market conditions which change without notice. This could impact the accuracy of the information.

Under no circumstances is the information to be used by, or presented to, a person for the purposes of deciding about investing in Raiz Invest or Raiz Invest Super.

Past return performance of the Raiz products should not be relied on for making a decision to invest in a Raiz product and is not a good predictor of future performance.

* For the new rules, there are certain eligibility criteria, which are not trivial, so you do need to check with a licensed tax adviser (or other) before deciding to make voluntary contributions and claim a deduction.