What we have learnt in a year since the market lows of COVID-19

It is hard to believe it has been a year since the equity markets were plunged into the crisis of COVID-19, reaching lows on March 23rd, 2020. But since then, markets have not only survived, they have thrived.

While that has surprised many, the reasons for the big recovery may be explained by some of the following points.

The equity markets and the economy are two separate things

It is not always easy to distinguish equities from the wider economy. But when investors buy shares in a company, or an ETF comprised of many shares, they are buying into the future visions and future earnings. In theory it is not what a company or a sector does today that defines its value, but the potential of what it could do tomorrow, and every day into the future.

So while COVID hit economies hard, and lockdowns crippled many businesses, those businesses and sectors that have withstood the tough conditions are being priced on all of their potential future performances, not just what they were limited to during the lockdowns. This means that investors are confident that businesses can return to some new state of normal, and even grow, in the coming months and years ahead. And given this new-found normal has resulted in more remote solutions, many Tech firms have performed extremely well in the past year, driven by innovation and a large growth in customer numbers.

The US Fed will do whatever it takes, as will other central banks

Trillions of dollars and Euros have been printed during the past year, and it is likely that printing of money will continue. This has been done to enable Central Banks to buy bonds, which support both Governments, Banks and Businesses to continue functioning. Buying bonds also has the effect of keeping interest rates low, which in turn has accelerated many share prices higher. The Central Banks have been aiming to keeping bond yields low to support businesses by enabling them to borrow cheaply and continue to operate in a near zero interest rate environment. Central banks globally have been extremely vocal that they will do whatever it takes to keep their economies functioning, and this has accelerated equities from 2020 lows.

Low interest rates mean there has been significant funds moving into equities

This chain reaction has been two-pronged. Firstly, with trillions of newly printed currencies floating about, this money has started to find its way through various asset classes, including equities, commodities and even crypto. This is because investors have been less incentivised to accept near zero rate of return from interest rates, and with more money being printed, have been moving into assets that often thrive in low interest rate conditions, like growth stocks. This is because the cost of capital in a low interest world is very small, so companies have been incentivised to chase growth, and for the time being it has not been at the expense of the shareholder to pursue this strategy.

Markets are back towards record highs, with global optimism about a return to growth

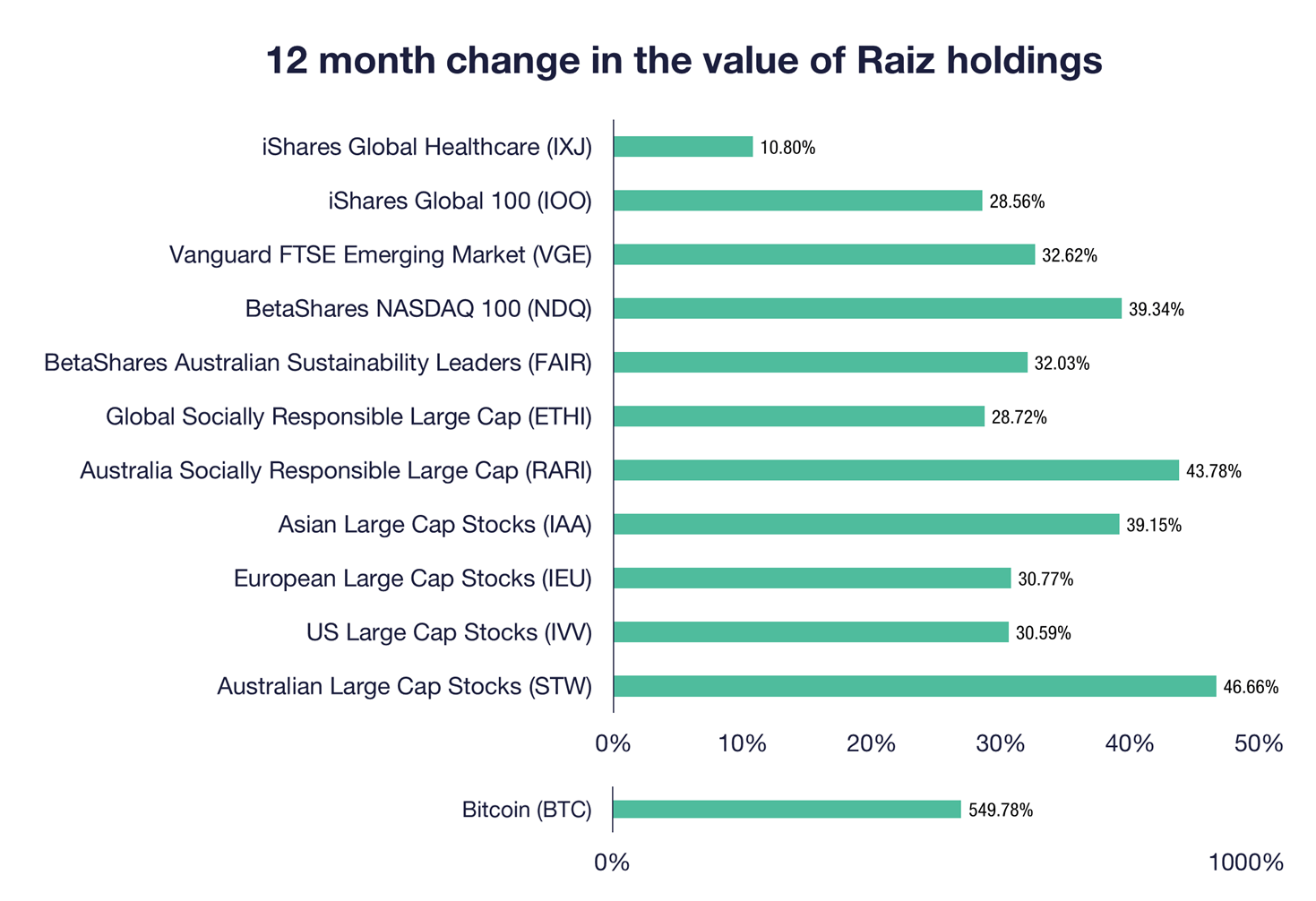

The S&P, Dow and Nasdaq indices have all touched new record highs many times already in 2021, and many benchmarks are still trading within a few percent of record highs. The twelve month returns below shows performance since the March 2020 lows and takes into account the strength of the AUD for ETFS that track the US markets. This is because the AUD has also moved up from US55c to over US76c in that time, up almost 40%.

What the chart really demonstrates is the need for investors to be patient for the medium and long term. While we would all love to have invested at the lows, those who sold as markets fell or did not dollar cost average may have missed strong gains experienced in the past 12 months. Although these 12 month returns are eye-catching, remember that investing does carry risk. You can read about the risks and fees relevant to investing with Raiz in our PDS. Finally, always remember past performance is not a reliable indicator of future performance and should not be relied on for making investment decisions.

Don’t have the Raiz App?

Download it for free in the App store or the Webapp below:

Important Information

If you have read all or any part of our email, website, or communication then you need to know that this is factual information and general advice only. This means it does not consider any person’s particular financial objectives, financial situation, or financial needs. If you are an investor, you should consult a licensed adviser before acting on any information to fully understand the benefits and risk associated with the product. This is your call but that is what you should do.

You may be surprised to learn that RAIZ Invest Australia Limited (ABN 26 604 402 815) (Raiz), an authorised representative AFSL 434776 prepared this information.

We are not allowed, and have not prepared this information to offer financial product advice or a recommendation in relation to any investments or securities. If we did give you personal advice, which we did not, then the use of the Raiz App would be a lot more expensive than the current pricing – sorry but true. You therefore should not rely on this information to make investment decisions, because it was not about you for once, and unfortunately, we cannot advise you on who or what you can rely on – again sorry.

A Product Disclosure Statement (PDS) for Raiz Invest and/or Raiz Invest Super is available on the Raiz Invest website and App. A person must read and consider the PDS before deciding whether, or not, to acquire and/or continue to hold interests in the financial product. We know and ASIC research shows that you probably won’t, but we want you to, and we encourage you to read the PDS so you know exactly what the product does, its risks and costs. If you don’t read the PDS, it’s a bit like flying blind. Probably not a good idea.

The risks and fees for investing are fully set out in the PDS and include the risks that would ordinarily apply to investing. You should note, as illustrated by the global financial crisis of 2008, that sometimes not even professionals in the financial services sector understand the ordinary risks of investing – because by their nature many risks are unknown – but you still need to give it a go and try to understand the risks set out in the PDS.

Any returns shown or implied are not forecasts and are not reliable guides or predictors of future performance. Those of you who cannot afford financial advice may be considering ignoring this statement, but please don’t, it is so true.

Under no circumstance is the information to be used by, or presented to, a person for the purposes of deciding about investing in Raiz Invest or Raiz Invest Super.

This information may be based on assumptions or market conditions which change without notice and have not been independently verified. Basically, this says nothing stays the same for long in financial markets (or even in life for that matter) and we are sorry. We try, but we can’t promise that the information is accurate, or stays accurate.

Any opinions or information expressed are subject to change without notice; that’s just the way we roll.

The bundll and superbundll products are provided by FlexiCards Australia Pty Ltd ABN 31 099 651 877 Australian credit licence number 247415. Bundll, snooze and superbundll are trademarks of Flexirent Capital Pty Ltd, a subsidiary of FlexiGroup Limited. Lots of names, which basically you aren’t allowed to reproduce without their permission and we need to include here.

Mastercard is a registered trademark and the circles design is a trademark of Mastercard International Incorporated.

Home loans are subject to approval from the lending institution and Raiz Home Ownership makes no warranties as to the success of an application until all relevant information has been provided.

Raiz Home Ownership Pty Ltd (ABN 14 645 876 937), an Australian Credit Representative number 528594 under Australian Credit Licence number 387025. Raiz Home Ownership Pty Ltd is 100% owned by Raiz Invest Australia Limited (ABN 26 604 402 815).