Qantas Airways takes off as share sales soar 231 per cent

Qantas Airways ($QAN) has come out steaming ahead this week on the Raiz platform, storming up the charts for a silver medal finish. The national airline has close to 8000 shares traded this week, an increase of 231 per cent which saw it move from sixth place last week to now second place. Reports have surfaced this week that ASIC has recently raised questions about certain price movements in the flying kangaroo shares last year. ASIC wrote to the ACCC about its timeline of investigation into the airline, to see if directors or executives knew about the investigation before it happened or before the drop in the share price. Despite these legal issues, it’s still a popular stock to own.

A broker’s note from Morgans shows its analysts have retained their add rating with an improved price target of $7. The broker expects payouts to resume from FY25 while also retaining that it expects a profit of over $2B over the financial year.

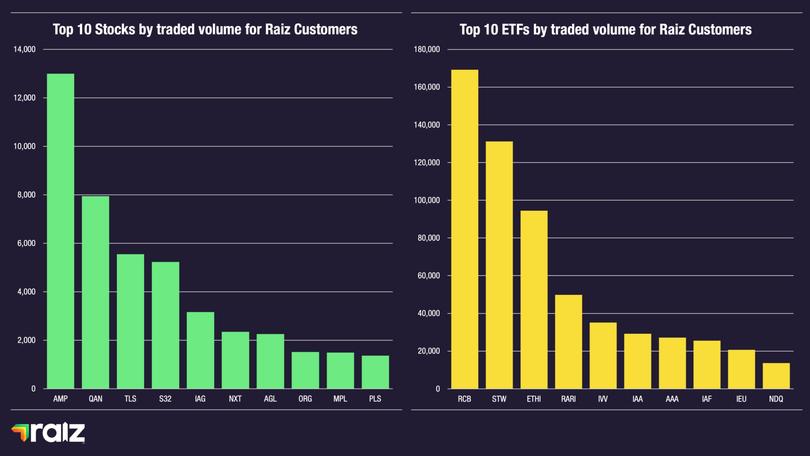

Overall, trading this week was up a massive 20 per cent, with over 43 thousand shares traded across the last seven days. While Qantas has the biggest increase, Telstra and NEXT DC also fared well over the period. NEXTDC ($NXT) was up over 164 per cent over the last seven days to make 2,350 shares traded. The last few weeks have seen shares traded in the company hover around the 1,000 mark and this week marks its first time in the top 10.

It’s been a popular tech stock amongst finance watches this week due to its exposure to AI. The company has seen increased demand for its data centres and ongoing drive for cloud computing.

Telstra ($TLS) trades were also up by 143 per cent which saw it go from seventh in the rankings to third. Its share price lifted higher this week after revealing it would be amending the prices of its mobile plans by between $2 and $4 a month. It’s part of a broader move by the company to move beyond inflation-linked prices to provide better flexibility.

Pilbara Minerals ($PLS) managed to cling onto its top 10 spot despite a 48 per cent drop in shares traded. The company recently saw an upgraded rating from JPMorgan from a sell to a neutral, but with the same price target. This is an indicator that the lithium stocks share price may have finished falling, but of course that is just one analyst. The ETF market saw an 8 per cent dip in trading activity amongst the top 10 this week but still had over 596,000 units trades made.

Most of the top 10 saw a dip in units traded with the biggest laggards being the Russell Investments Australian Responsible Investment ($RARI) ETF which saw a 22 per cent dip and iShares Asia 50 ($IAA) which saw an 18 per cent drop. Only two ETFs saw an uptick in units traded, being the iShares Europe ($IEU) with a 3 per cent boost and BetaShares NASDAQ 100 ($NDQ) with 65 per cent.

The NASDAQ hit its seventh straight record-high close this week, buoyed by Nvidia and Apple, the latter of which climbed 1.9 per cent to a record high this week.

Published 12/7/2024

Don’t have the Raiz App?

Download it for free in the App store or the Webapp below:

Important Information

Raiz Invest Australia Limited – Authorised Representative of AFSL 434776. The Raiz Invest Australia Fund and Raiz Property Fund are issued in Australia by Instreet Investment Limited (ACN 128 813 016 AFSL 434776) a subsidiary of Raiz Invest Limited and promoted by Raiz Invest Australia Limited (ACN 604 402 815).

Raiz Invest Super is a Division of AMG Super and is issued by Equity Trustees Superannuation Limited (AFSL 229757, RSE Licence No L0001458) as Trustee of AMG Super.

The information is general information only and does not take into account of your personal financial situation, goals or needs. You should obtain financial advice tailored to your circumstances by a licensed financial adviser.

A Product Disclosure Statement (PDS) and Target Market Determination (TMD) for Raiz Invest Australia Fund, Raiz Invest Super and Raiz Property Fund (together, the Products) are available on the Raiz Invest website and App. Please read and consider the PDS and TMD to understand the risks and determine if the Products are suitable for you. The risks and fees are fully set out in the PDS and include the risks that would ordinarily apply to investing.

Any returns shown or implied are not forecasts and are not reliable guides or predictors of future performance.

Under no circumstance is the information to be used by, or presented to, a person for the purposes of deciding about investing in the Products.

This information may be based on assumptions or market conditions which change without notice and have not been independently verified.

Any opinions or information expressed are subject to change without notice.

Home loans are subject to approval from the lending institution and Raiz Home Ownership makes no warranties as to the success of an application until all relevant information has been provided.

Raiz Home Ownership Pty Ltd (ABN 14 645 876 937), an Australian Credit Representative number 528594 under Australian Credit Licence number 387025. Raiz Home Ownership Pty Ltd is 100% owned by Raiz Invest Australia Limited (ABN 26 604 402 815).