Market and Economic Update – 27/01/19

Market update from Raiz CEO, George Lucas

Global growth concerns continue

After a fine start to the year, equity prices came under a bit of pressure early last week due to concerns about the health of the global economy and I suspect that there is more stock market weakness to come this quarter.

The signals last week included official GDP data from China showing that its economy slowed in the last quarter of 2018 and the International Monetary Fund (IMF) revising down its projections for GDP growth this year and next in advanced and emerging economies.

The reason for the IMF’s downgrade was risks associated with trade tensions, the unwinding of fiscal stimulus in the US, downward GDP growth revisions for the euro-area.

On the plus side, reports that the Federal Reserve was considering an early end to its balance sheet reduction programme helped US and European stocks end the week higher.

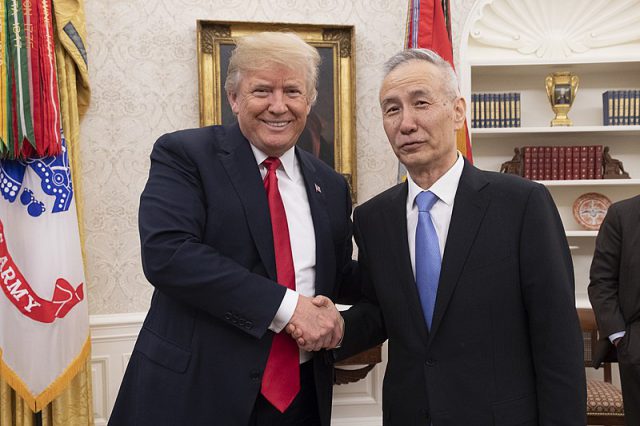

Market looks ahead to US-China trade talks

At the same time as some softness in equities, the US dollar, the Japanese yen – viewed by investors as “safe” assets – strengthened a bit while 10-year government bond yields generally fell, particularly US Treasury yields. The market also digested a mixed batch of quarterly US stock earnings.

All eyes are now on this week’s US-China trade talks in Washington and whether US Trade Representative Robert Lighthizer and US Treasury Secretary Steve Mnuchin can strike deal with the Chinese delegation led by Vice-Premier Liu He.

Draghi: Eurozone faces economic downturn

Turning to Europe, the president of the European Central Bank (ECB), Mario Draghi, warned that weaker growth in the global economy would continue to be felt in Europe, fuelling talk of a possible shift in policy guidance.

President Draghi’s comments came after the ECB left its key policy settings unchanged and indicated it is unlikely to raise them until summer, acknowledging the economy still needs monetary stimulus.

The ECB’s language was a significant shift away from the previous “broadly balanced” view of the outlook for the European economy, citing the persistence of risk factors, including trade tensions between China and the US, Brexit and a slowdown in China.

What’s more, while Draghi said there was no need to ease monetary policy, for now, I think the market suspects that the ECB will change the forward guidance on interest rates and unveil new targeted longer-term refinancing operations (TLTROs), before long.

The outlook for the euro-zone economy has deteriorated sharply in recent months and as a result I think that the ECB will leave rates on hold this year and next.

China’s economy cools in Q4

Looking more closely at breakdown of China’s Q4 GDP data, it points toward softer service sector activity on the back of slower property sales and weaker consumer spending. It’s likely that services growth will come under further pressure this year, as the labour market continues to weaken and households become even more cautious.

Meanwhile, in Australia, the decline in the unemployment rate to 5 per cent in December shows that the housing downturn hasn’t had much of an impact on the labour market yet.

Don’t have the Raiz App?

Download it for free in the App store or the Webapp below:

Important Note: The information on this website is provided for the use of licensed financial advisers only. The information is general advice and does not take into account any person’s particular investment objectives, financial situation or investment needs. If you are an investor, you should consult your licensed adviser before acting on any information contained in this website.

Investors only: The information in this Document is confidential it must not be reproduced, distributed or disclosed to any other person unless it is part of their statement of advice. The information may be based on assumptions or market conditions and may change without notice. This may impact the accuracy of the information. In no circumstances is the information in this Document to be used by, or presented to, a person for the purposes of making a decision about a financial product or class of products.

General advice warning: The information contained in this Document is general information only. It has been prepared without taking account any potential investors’ financial situation, objectives or needs and the appropriateness of this information needs to be considered in that context. No responsibility or liability is accepted by Instreet or any third party who has contributed to this Document for any of the information contained herein or for any action taken by you or any of your officers, employees, agents or associates.