Today we released the results of our new research, which found that many Australian consumers are blissfully unaware of what interest rate they earn on their bank savings according.

Our research found that 60 per cent of Aussies claim to have some level of knowledge when it comes to investing money, yet 85 per cent are unaware of the interest rate on their savings account. Additional findings show consumers are not clear about the safest investment options for their money.

The survey of 1,000 Australians was commissioned to identify consumers basic understanding of savings and investment options also looked at how recent events such as the Royal Banking Commission and the declining property market were impacting their perceptions of where to invest.

Cash is king, but a lot of us don’t know it

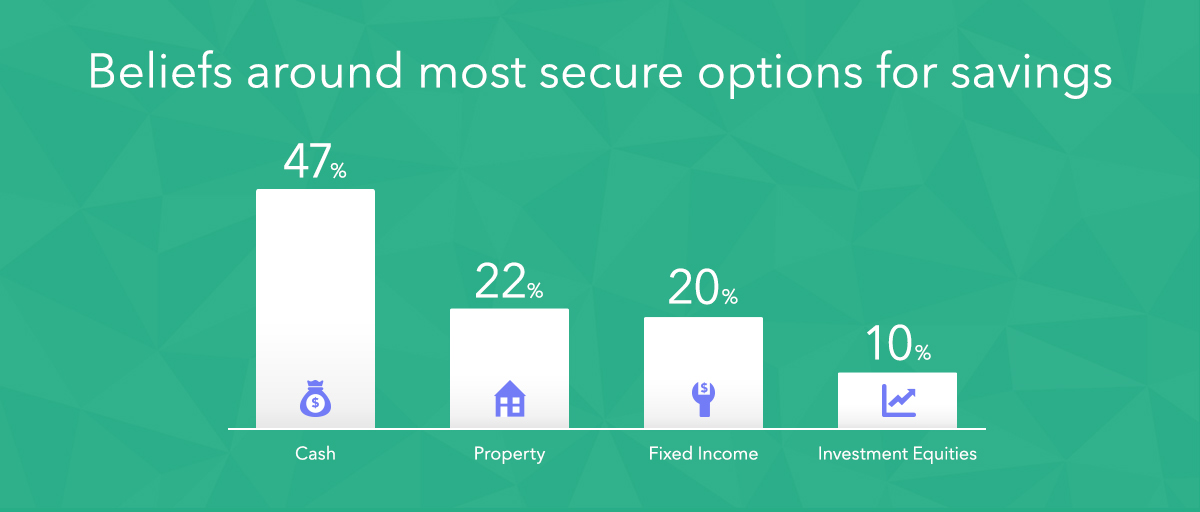

Our survey revealed that 53 per cent of Australians are unaware that cash is the safest place to invest money. Many believe property (22 per cent), fixed income (20 per cent) and investing in equities (10 per cent) are a more secure option for their savings.

Many Australians are completely unaware of the best options to protect and grow their income and think they’re getting 2-3 per cent on their savings accounts when, depending on the bank, it’s often less than 1 per cent.

This is due to the way saving accounts are advertised with introductory offers. At this interest rate, if Australians are using their savings accounts to save money, with inflation, the opposite is happening and they’re actually going backwards.. That’s why it’s important to ensure we’re educating consumers now on how to look after their money if they’re to become more financially stable in the future.

Women shying away from investment risk

Our research highlighted a sense of delusion when it comes to financial literacy, something which is even more recognisable amongst men. There’s no surprise then that the research found men have more diverse investment portfolios, with 38 per cent of men currently investing in the equity market, compared to 22 per cent of women.

The research shows us that women tend to be more risk averse. This is not a surprise as it’s also something we see at Raiz. For example, in the Raiz app, we have six portfolios for users to select from when investing their money. More men opt for the aggressive portfolios than women, who tend to select the more conservative options. This is not evidence that men are more financially literate than women. If anything, it indicates that men are taking more investment risks they don’t fully understand.

Distrust with the big banks continues to grow

The fallout of the recent Royal Banking Commission has certainly had its impact on confidence levels. Almost half (47 per cent) say they are less inclined to invest their money with the Big Four following the Hayne report.

For a while now, Australians have felt less inclined to invest with the big banks. There was an ethical line that many felt was crossed and now people are looking at alternative ways to invest their money.

More than half of those who took part in the research said they will now look to diversify their investments. This is where we think platforms such as Raiz offer support, especially for those wanting to get practical hands-on learning too.

Important Information

The information on this website is general advice only. This means it does not take into account any person’s particular investment objectives, financial situation or investment needs. If you are an investor, you should consult your licensed adviser before acting on any information contained in this article to fully understand the benefits and risk associated with the product.

A Product Disclosure Statement for Raiz Invest and/or Raiz Invest Super are available on the Raiz Invest website and App. A person must read and consider the Product Disclosure Statement in deciding whether, or not, to acquire and continue to hold interests in the product. The risks of investing in this product are fully set out in the Product Disclosure Statement and include the risks that would ordinarily apply to investing.

The information may be based on assumptions or market conditions which change without notice. This could impact the accuracy of the information.

Under no circumstances is the information to be used by, or presented to, a person for the purposes of deciding about investing in Raiz Invest or Raiz Invest Super.

Past return performance of the Raiz products should not be relied on for making a decision to invest in a Raiz product and is not a good predictor of future performance.