Are you considering how to find a better Super fund for you? Thinking about a move but don’t know where to start? Maybe you have a few potential Super funds in mind, or none.

Either way, below are some tips, discussion points and tools that will help you on the way to finding a better Super fund to suit your current needs and financial goals.

Visit Super fund comparison sites

If you are not familiar with the current Super funds available in the market, checking out Super fund comparison sites will help you familiarise and build a potential list of Super funds that better suit you. While one of the main things people may look at is the fund’s track record, it’s also important to note that past performance is no indication of future performance. This means other merits worth considering include the Super fund’s innovations, additional features, life insurance products, awards, and customer experience.

Resources by Super fund providers

While the first place to check for more information on a Super fund is their website product page and product disclosure statement, it is also a good idea to explore additional resources they provide. Do they have Super related blogs with useful information? How easy are these resources to find? Are they active in the media about Super? While it’s unlikely you will have the time to read everything in detail, by exploring their activity, this can show you how committed they are in providing resources and information to make the most out of your Super money. It will also give you a better idea of their values and investment strategies, and whether they align with yours.

What other services or products does the fund provide?

If you have a potential Super fund you’re considering switching over to, a great place to determine if this Super fund suits you better is looking at the other services or products you may already have with them. What other products do they offer? What is their customer service experience like? What is their life insurance offering like? Are you a current customer of theirs and are you satisfied with their services?

For example, the Raiz Invest Super product has the same investment strategies as the non-super Raiz Invest products (excluding Custom and Sapphire Portfolios). This allows Raiz users to get a feel for the market and your risk tolerance before committing to switching over all your retirement funds to Raiz Invest Super. The same customer service representatives are trained to handle both products as well allowing for a seamless interaction, all without being transferred from department to department. For more information on Raiz Invest Super, including investment risks and fees please read the PDS.

Family and Friends

Money can sometimes feel like a taboo topic to talk about among family or friends, but it’s important to learn how to be comfortable talking about your financial wellbeing, the same way you would talk to your family and friends about your mental wellbeing. Starting a conversion about Super funds might be an easy first step into this. You might be surprised by some of your friends or family who have already done research into finding a better Super fund, have made the switch already or can explain their experiences with you.

Read up on life insurance

While superannuation is frequently mentioned as a key part towards financial wellbeing, life insurance is less commonly talked about. Even though more than 70% of Australians holding life insurance, do this through their Super fund. Therefore, it’s important to understand what is generally covered on this type of insurance through your Super fund, the benefits you are paying for and whether it suits your circumstance. A great starting place is the Money Smart website – “Insurance through super – A financial safety net through your super”.

Money Calculator

Another great resource from the Money Smart website is the compound interest calculator. If you are planning to do personal contributions or are wondering how much you could potentially earn from investing a little extra now, this calculator will show you how the time-proven strategy of dollar cost averaging and compound interest works. For example, if you are using Raiz Rewards and would like to voluntarily contribute these cash investments into your Super fund instead, you could input your current Super balance in ‘Initial Deposit’ and the average monthly Raiz Rewards you get in ‘Regular Deposits’.

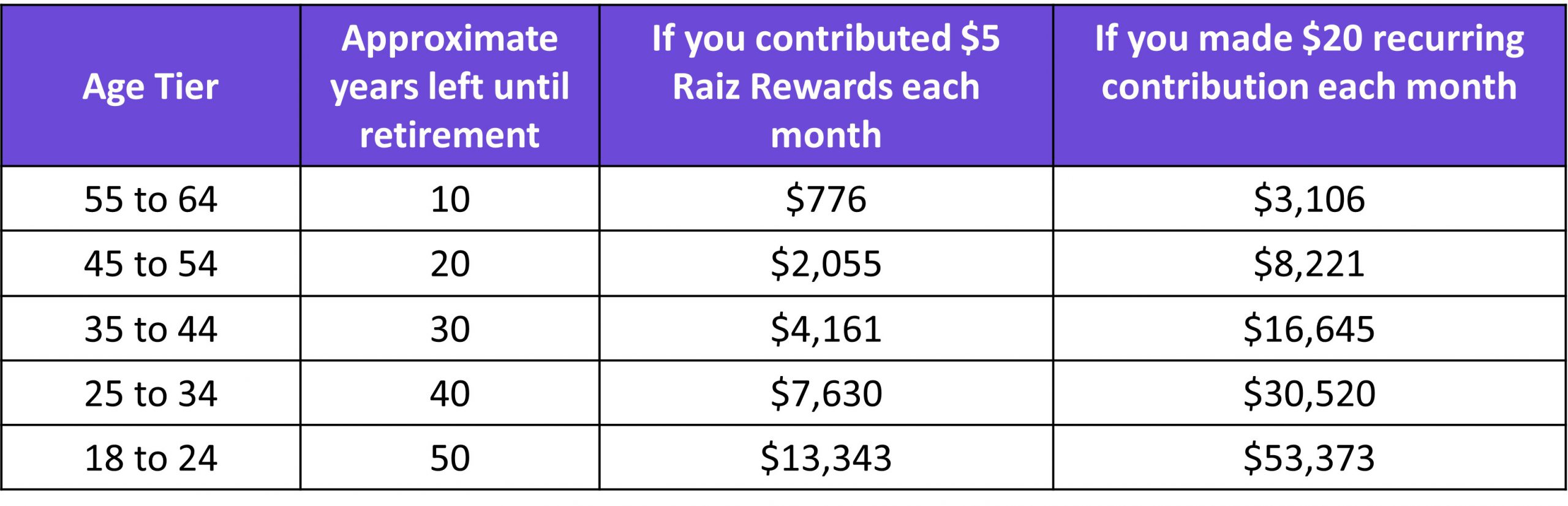

In the below example, by investing $5 a month via Raiz Rewards or making voluntary recurring contributions of $20, over the span of 40 years at 5% p.a. return net of fees, these extra contributions could be worth $7,630 and $30,520 respectively towards your retirement. It is worth noting that the inflation rate over time can impact the value of these voluntary contributions.

You can also check out our blog on How Much Super is Enough, because each person will have a different amount of time left until retirement age, a different wage or salary, and a different amount currently in their super.

Summary

Despite us not being able to spend our Super funds now, this is money that is part of your income, and therefore important to look after throughout your life. With these tips and tools, along with some important checklist considerations on finding a better Super fund, you’re well on your way in making the best decision for yourself now and in the future!

Don’t have the Raiz App?

Download it for free in the App store or the Webapp below:

Important Information

If you have read all or any part of our email, website, or communication then you need to know that this is factual information and general advice only. This means it does not consider any person’s particular financial objectives, financial situation, or financial needs. If you are an investor, you should consult a licensed adviser before acting on any information to fully understand the benefits and risk associated with the product. This is your call but that is what you should do.

You may be surprised to learn that RAIZ Invest Australia Limited (ABN 26 604 402 815) (Raiz), an authorised representative AFSL 434776 prepared this information.

We are not allowed, and have not prepared this information to offer financial product advice or a recommendation in relation to any investments or securities. If we did give you personal advice, which we did not, then the use of the Raiz App would be a lot more expensive than the current pricing – sorry but true. You therefore should not rely on this information to make investment decisions, because it was not about you for once, and unfortunately, we cannot advise you on who or what you can rely on – again sorry.

A Product Disclosure Statement (PDS) for Raiz Invest and/or Raiz Invest Super is available on the Raiz Invest website and App. A person must read and consider the PDS before deciding whether, or not, to acquire and/or continue to hold interests in the financial product. We know and ASIC research shows that you probably won’t, but we want you to, and we encourage you to read the PDS so you know exactly what the product does, its risks and costs. If you don’t read the PDS, it’s a bit like flying blind. Probably not a good idea.

The risks and fees for investing are fully set out in the PDS and include the risks that would ordinarily apply to investing. You should note, as illustrated by the global financial crisis of 2008, that sometimes not even professionals in the financial services sector understand the ordinary risks of investing – because by their nature many risks are unknown – but you still need to give it a go and try to understand the risks set out in the PDS.

Any returns shown or implied are not forecasts and are not reliable guides or predictors of future performance. Those of you who cannot afford financial advice may be considering ignoring this statement, but please don’t, it is so true.

Under no circumstance is the information to be used by, or presented to, a person for the purposes of deciding about investing in Raiz Invest or Raiz Invest Super.

This information may be based on assumptions or market conditions which change without notice and have not been independently verified. Basically, this says nothing stays the same for long in financial markets (or even in life for that matter) and we are sorry. We try, but we can’t promise that the information is accurate, or stays accurate.

Any opinions or information expressed are subject to change without notice; that’s just the way we roll.

The bundll and superbundll products are provided by FlexiCards Australia Pty Ltd ABN 31 099 651 877 Australian credit licence number 247415. Bundll, snooze and superbundll are trademarks of Flexirent Capital Pty Ltd, a subsidiary of FlexiGroup Limited. Lots of names, which basically you aren’t allowed to reproduce without their permission and we need to include here.

Mastercard is a registered trademark and the circles design is a trademark of Mastercard International Incorporated.

Home loans are subject to approval from the lending institution and Raiz Home Ownership makes no warranties as to the success of an application until all relevant information has been provided.

Raiz Home Ownership Pty Ltd (ABN 14 645 876 937), an Australian Credit Representative number 528594 under Australian Credit Licence number 387025. Raiz Home Ownership Pty Ltd is 100% owned by Raiz Invest Australia Limited (ABN 26 604 402 815).

(ABN 26 604 402 815).