A guide to socially responsible investing

What is socially responsible investing?

Socially responsible investing can be thought of as a philosophy to investing, where the investor makes a conscious effort to invest in companies that align with their ethical ideology. A common example is not investing in companies that promote or produce products related to addictive substances (tobacco, gambling etc.). Positive and negative screening are two methods that can be used to determine which companies are suitably socially responsible to warrant your investment. Positive screening seeks to include companies with attributes that align with your social and ethical expectations, such as having a low carbon footprint or a gender diverse board. Negative screening seeks to exclude companies with attributes that contradict your moral expectations. These could be companies that have significant environmental impacts or poor working conditions. Essentially, positive screening gives preference to causes you are passionate about, whilst negative screening filters out companies with characteristics you morally oppose. Of course, both these methods can be used in combination when searching for companies that align with an investor’s ethics and values.

Socially Responsible Investing can have a positive impact

An analysis from MSCI found that the performance of two portfolios screened to overweight stocks with higher ratings in environmental, social and governance (ESG) characteristics outperformed the global benchmark over the last eight years. This is because many ESG stocks are technology companies such as Amazon, Google and Apple, and excludes many energy companies (such as oil companies which due to the price of oil have under-performed the market). In Australia, investors have been at the forefront of sustainable or responsible. It is estimated in Australia that responsible investment accounted for $866 billion in assets under management in 2018, up 37 per cent from $633 billion in 2016. With global socially responsible investments totalling US$30.7 trillion.

Raiz democratises access to socially responsible investing

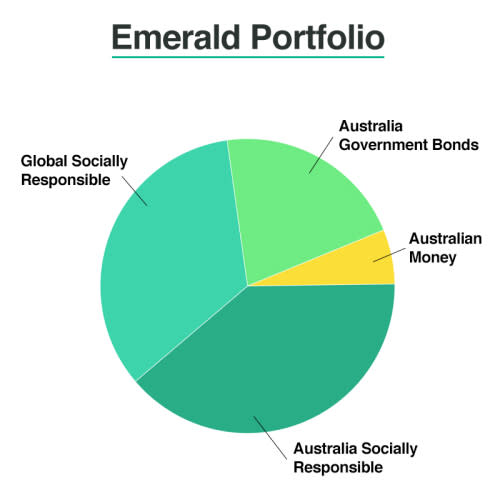

Traditionally, investing has often been perceived as a luxury reserved for those with enough knowledge and wealth, due to complicated and often jargonistic finance rhetoric, combined with minimum investment amounts ranging in the hundreds or even thousands of dollars. If you’re looking for exposure to socially responsible investing, the Raiz Emerald portfolio may be a great place to start. The Emerald portfolio is our ESG option that assists in matching investments with personal values. It provides investors exposure to large ESG Australian and Global companies, with top holdings primarily including technology and health companies. For more information on Raiz fees, click here.

The Emerald Portfolio is our ESG option

The ‘Russell Investments Australian Responsible Investment’ (RARI) ETF makes up the Australia Socially Responsible allocation of the portfolio. It uses a mixture of both positive and negative screening, weighted to track companies that demonstrate positive ESG characteristics, after first screening out companies that have significant involvement in a range of characteristics deemed inconsistent with widely recognised responsible investment considerations. As more people consider ESG companies to invest in, the view is that by investing in companies based on environmental and social considerations, it can be possible to hold investments that may not compromise on market risk or long-term performance.